What I Learned from Every Annual Letter of Francois Rochon

Francois Rochon's Investment Journey: Key Lessons from His Annual Letters

“In order to be a jazz musician, you have to listen to a lot of jazz. And that’s an act of love. You don’t think, I’m listening to study it. You just listen because you love it…and gradually you learn. You really learn everything valuable through osmosis. It’s the same with play-writing or movie-directing or acting. You love either reading or watching films or plays or listening to music. And in some way, over the years, without making any attempt, it gets into your blood, into the fiber of your body.” - Woody Allen

Learning through passion is also at the heart of investing, or as Rochon calls it “The Art of Investing.” This passion for investing is why I read all the annual letters of Francois Rochon, and why I started this blog. That's also why this blog is quite extensive—I don’t want to leave out important knowledge shared by Rochon. I've gained a lot of insights and knowledge that I hope to share with you, just as jazz musicians share their latest song.

I'll be covering the following key lessons I learned from reading all the annual letters from the quality investor, Francois Rochon.

Rochon’s Investing Philosophy

Rochon’s Own Most Important Lessons

Rochon’s Stock Selection Process

The Importance of Good Management

Rochon’s Valuation Process

Owner’s Earnings

What Rochon Avoids in Investments

When Does Rochon Sell an Investment?

The Power of Humility, Rationality, Patience and Positivity

The Rule of Three

Crises Create Opportunities

The Podium of Errors

The Flavor of the Day

Why Invest in Stocks Instead of Gold, Treasuries (and Crypto)

Why You Shouldn’t Predict The Market

The Missing Gene Hypothesis

1. Rochon’s Investing Philosophy

Rochon’s investment approach can be summed up in one sentence: acquire outstanding businesses managed by top-notch people, and buy their stocks when they look undervalued. He laid out this philosophy perfectly in his 2001 letter with an Oscar Wilde quote: "I have the simplest of tastes: I only like the best."

The investing philosophy of Rochon is heavily influenced by five key investors: Warren Buffett, Benjamin Graham, John Templeton, Philip Fisher, and Peter Lynch. In his 2018 letter, Rochon explained why these legendary investors generated higher returns than the indexes over the long term. The secret? They viewed buying a stock as purchasing a business and aimed to buy these businesses at a significant discount to their intrinsic values. This is a great starting point for understanding Rochon’s philosophy.

In his 2020 letter, amidst market chaos with a 33% plunge and recovery in the same year, Rochon remained calm due to his belief in his approach. He stated: “Our philosophy remains very simple: we own approximately twenty companies with solid balance sheets, conservative accounting, a durable competitive advantage, and a management team dedicated to shareholders. And, of course, we are always cautious about the price we are willing to pay for such companies.”

The cornerstone of Rochon's philosophy is that exceptional returns come from owning assets that inherently generate exceptional returns. For Rochon, the best assets are productive ones that create continuous wealth. He aims to find companies growing intrinsic value (EPS) 12-14% per year, twice the market average. Over many years (i.e. the long run), market performance will align with earnings growth, leading to outsized returns for Rochon’s high(er)-quality businesses.

Rochon outlines his “Investment Philosophy” in more detail at the end of each letter. Here are his key points:

Stocks Are The Best: We believe that over the long run, stocks are the best class of investments.

Don’t Predict: It is futile to predict when it will be the best time to begin buying (or selling) stocks.

Stocks Follow EPS: A stock return will eventually echo the increase in per share intrinsic value of the underlaying company (usually linked to the return on equity).

Quality Companies: We choose companies that have high (and sustainable) margins and high returns on equity, good long term prospects and are managed by brilliant, honest, and dedicated people.

Avoid Risky Companies: We avoid risky companies: non-profitable businesses, with too much debt, with a lot of cyclicality and/or run by people motivated by ego instead of genuine stewardship.

Realistic Valuation: Once a company has been selected for its exceptional qualities, a realistic valuation of its intrinsic value has to be approximately assessed.

Don’t Gamble: The stock market is dominated by participants that perceive stocks as casino chips. With that knowledge, we can then sometimes buy great businesses well below their intrinsic values.

Be Patient: There can be quite some time before the market recognizes the true value of our companies. But if we’re right on the business, we will eventually be right on the stock.

Here are a few more practical insights I found from the letters and a podcast:

~20 Securities: A portfolio of about 20 securities offers enough diversification to reduce risk while increasing the odds of beating market indices (2016).

Understand the Business: Avoid companies dependent on volatile factors like oil prices. That’s because it’s crucial to understand a business for making accurate earnings estimates, assessing competitive advantages, and determining fair prices (2014).

Long-term > Short-term: Focus on long-term value rather than short-term market movements (2006).

100% Invested: He stays almost fully invested. During downturns, he upgrades his portfolio by swapping less affected stocks for those with better growth prospects, making the most of market drops (podcast).

Low Turnover: Rochon’s portfolio turnover is around 15%, meaning he holds stocks for 6-7 years on average. This long-term approach is essential for generating exceptional returns (2015).

John Templeton once said: "It is impossible to obtain a performance superior to the average unless you do something different from the average". That’s why Rochon’s philosophy is centered around “better than average” (i.e. high-quality). Or as he stated in his 2022 letter: “The key to doing better than average is owning superior than average companies.” Essentially, Rochon seeks to own masterpieces.

2. Rochon’s Own Most Important Lessons

In 2013, Rochon listed the ten most important lessons he learned in the 20 years of running his fund. If he says these are the most important lessons, then I must include them in my favorite lessons of Rochon as well of course:

10. Investing in the stock market is not a game.

It is about acquiring partial ownership in companies.

9. Beating the market is harder than most people think.

People don’t beat the market because they are the market. Beating the market requires a total devotion to the art of investing in addition to the right temperament toward market fluctuations.

8. Short-term results can be caused by luck as much as by skill.

Results over a few years don’t mean much. But over the long term, chance evens out and investment principles prevail.

7. The more an industry changes, the riskier it is to invest in.

Industries that change quickly can be good for customers but bad for shareholders.

6. Beware of IPOs

The price set is rarely advantageous to the buyer.

5. Most people are wrong most of the time.

However, the irony is that most people think they know more than the others.

4. Price and value are not the same thing.

Price is what you pay, value is what you get. Stocks sell at half what they are worth and some are way overvalued. A great business is not always a great stock. Although it is a mistake to solely focus on price, it is an important factor.

3. Look for a company with a competitive advantage.

The business world is extremely competitive. Companies that do better than average - over many years - have a competitive advantage.

2. One key ingredient is the management.

Most of the big winners are linked to the fact that the management of the company was outstanding.

1. It is futile to try to predict the stock market over the short run.

All the previous lessons are useless if you try to predict the stock market over the short run. I have heard people say hundreds of times that they are waiting to buy great companies because they had some views on the short-term direction of the stock market. Owning great businesses, managed by great people and acquired at reasonable prices is the winning recipe.

3. Rochon’s Stock Selection Process

Rochon generally focuses on five key areas when analyzing a company:

Business Model: Does he understand how the company makes money? How much market share does it have? What about product innovation?

Financials: Does the company have a healthy balance sheet? High profit margins? Are most earnings converted into free cash flow?

Management Quality: Does the management allocate capital efficiently? Do they have skin in the game? Are they passionate about their product or service?

Outlook: Can the company grow its earnings at an attractive rate (over 12%)? Is it part of a strong, ongoing trend?

Valuation: Is the company over- or undervalued compared to its historical average? How has its intrinsic value changed over time relative to its valuation?

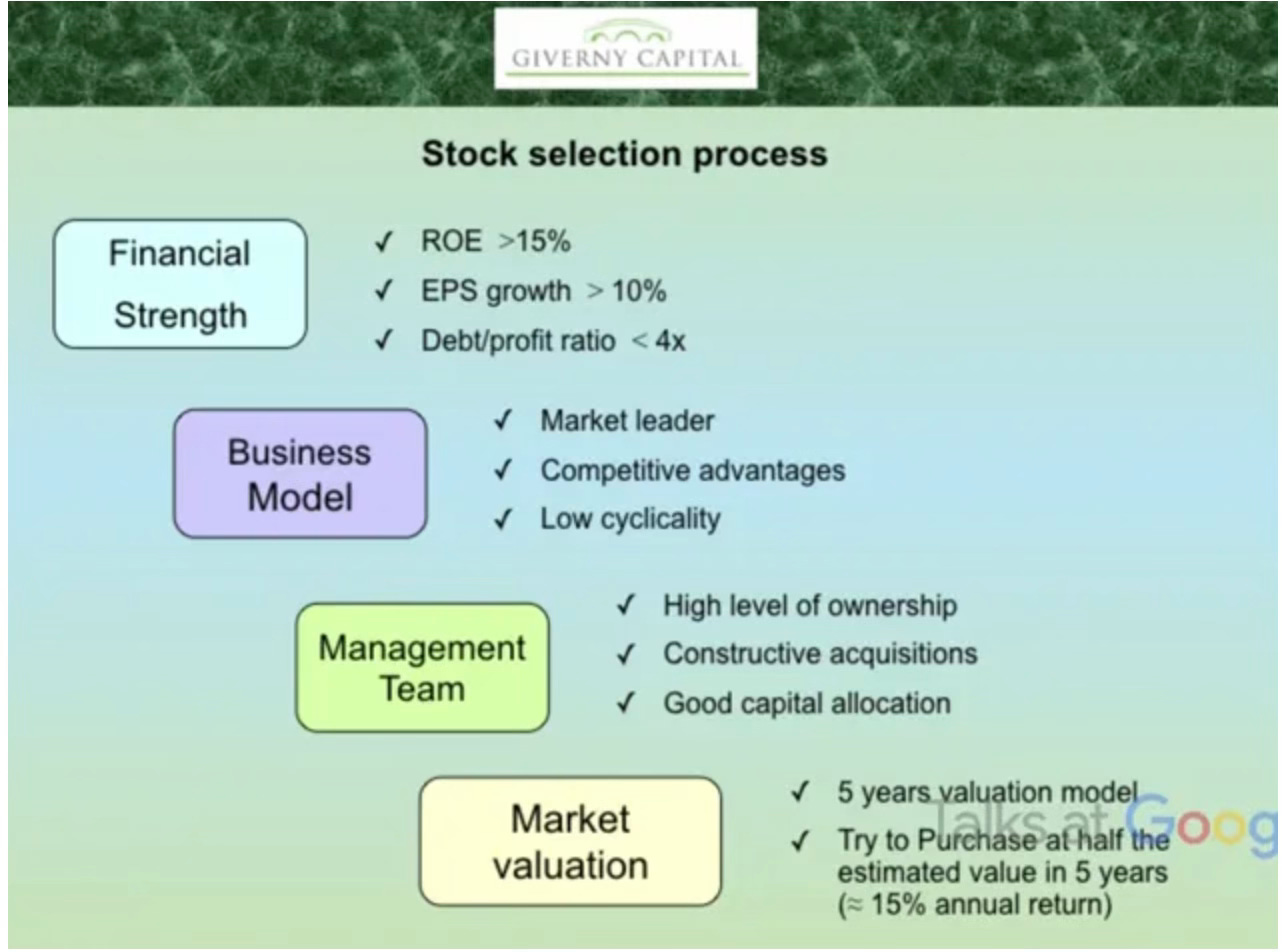

Rochon picks quality companies with competitive advantages that have high and sustainable margins, high returns on capital, and good long-term prospects. These companies are led by brilliant, honest and dedicated people, and he makes sure not to overpay for them. Sounds simple, right? Here’s a picture Rochon used in his talk at Google talking about his stock selection process in a bit more detail. You can find it on Youtube!

If you want to chat about anything in this picture, just shoot me a message. I'd love to dive deeper into it. I should mention that Rochon insists on really understanding the first three factors (Financial Strength, Business Model, and Management) before moving on to market valuation. This shows that valuation isn't the most crucial part of analyzing or investing in stocks. The big issue with not fully grasping a business and its growth potential is that you might make wrong assumptions, leading to an incorrect valuation. This could mean overpaying for a company or, even worse, missing out on a great one.

Essentially, his strategy for picking the right companies comes down to:

A strong and sustainable competitive advantage.

Long-term growth potential.

A solid balance sheet.

High returns on capital.

A capable management team that works for the long-term benefit of all stakeholders.

(6. All while paying a reasonable valuation)

4. The Importance of Good Management

François Rochon places huge importance on management when picking companies to invest in. For him, investing means partnering with great people. Beyond intelligence and competence, which almost all top managers have, Rochon values deeper qualities, especially integrity. He wants managers who love the business more than the money. As Warren Buffett puts it, “Is this person more in love with the business than money?” Managers should treat investors as they'd want to be treated themselves (2005).

Rochon loves insider ownership, saying, “We’re in the same vehicle as them!” When managers have their own money invested (i.e. skin in the game), their interests align with those of shareholders, leading to better decisions for the company (2007).

The legendary quality investor Philip Fisher also wanted to invest alongside great managers saying, “In my books, I’ve always placed the emphasis on the importance of the management team in selecting companies… and yet, I didn’t do it enough” (2013).

5. Rochon’s Valuation Process

François Rochon keeps his approach to valuing companies simple and practical. He estimates future earnings per share (EPS), applies a conservative price-earnings (P/E) multiple, and then compares this to the current stock price. This straightforward method requires a deep understanding of the company to accurately estimate its future EPS. While valuation is important, Rochon doesn't obsess over it and he likely avoids complex discounted cash flow (DCF) models (2014).

Rochon's Valuation Approach

Rochon focuses on two main questions:

How much will the company earn (EPS) 5 years from now?

What is a fair P/E multiple for this company?

For example, let’s say Company X earns $1 per share and trades at a P/E multiple of 18 today (thus trading at $18 per share). Rochon then makes the two assumptions:

Rochon expects that in five years, the company will earn $2 per share

A fair P/E multiple for the company to trade at is 20.

Based on these assumptions, the stock price in five years would be $40 (calculated as $2 EPS * 20 P/E). This means the share price would increase from $18 today to $40 in five years. That’s a 122.2% return over five years, or about a 17.3% annual return.

Rochon aims for a 15% annual return, meaning he expects the stock to double every five years. This 15% target gives him a margin of safety if his assumptions are off.

By sticking to this simple and conservative method, Rochon makes sure his investment decisions are grounded in realistic expectations. However, in order to make the right assumptions, an investor needs a very good understanding of the business and its prospects. As Buffett would say: “Investing is simple, but not easy.”

6. Owner’s Earnings

François Rochon explains that in the long run, stock prices tend to follow a company's Owner’s Earnings. This idea is based on Warren Buffett's "look-through" earnings, which he first talked about in his 1989 shareholder letter.

So, how do you calculate Owner’s Earnings? You estimate the increase in the intrinsic value of your companies by adding the growth in earnings per share (EPS) and the average dividend yield of the portfolio.

To break it down:

Multiply the EPS by the number of shares you own in each company.

Sum them all up and compare the total to the previous year.

Add the average dividend yield to this growth rate, and you have your Owner’s Earnings.

This method isn't perfectly precise, but as Keynes said, “it is better to be roughly right than precisely wrong.”

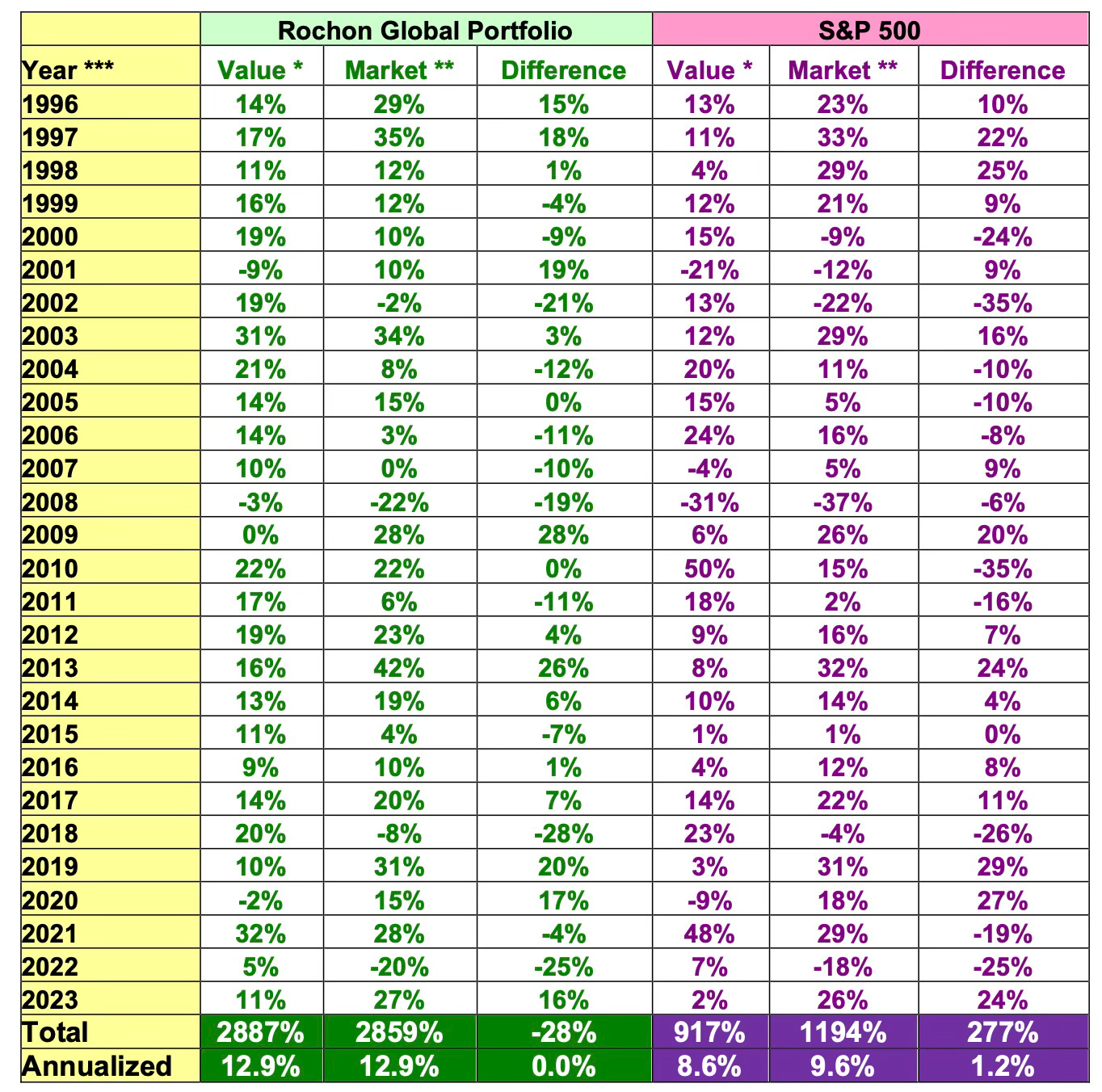

As you can see, Giverny Capital’s Portfolio increased its Owner’s Earnings by 2887% (including dividends) since 1996, almost perfectly matching the portfolio’s performance increase of 2859%. While short-term discrepancies can occur between Owner’s Earnings and stock performance, in the long term, stock prices usually follow the Owner’s Earnings.

Correlation between Profits and Performance

Let's dive a bit more into this correlation between profits and performance. In 2016, Rochon emphasized the strong link between the stock market’s performance and the performance of the underlying companies over the long run. From 1993 to 2016, the profits of S&P 500 companies grew by 450% (7.3% annualized), while the stock market rose by 429% (7.2% annualized). Despite recessions, elections, wars, crises, and terrorist attacks, the market performed well because the companies in the index thrived through these challenges.

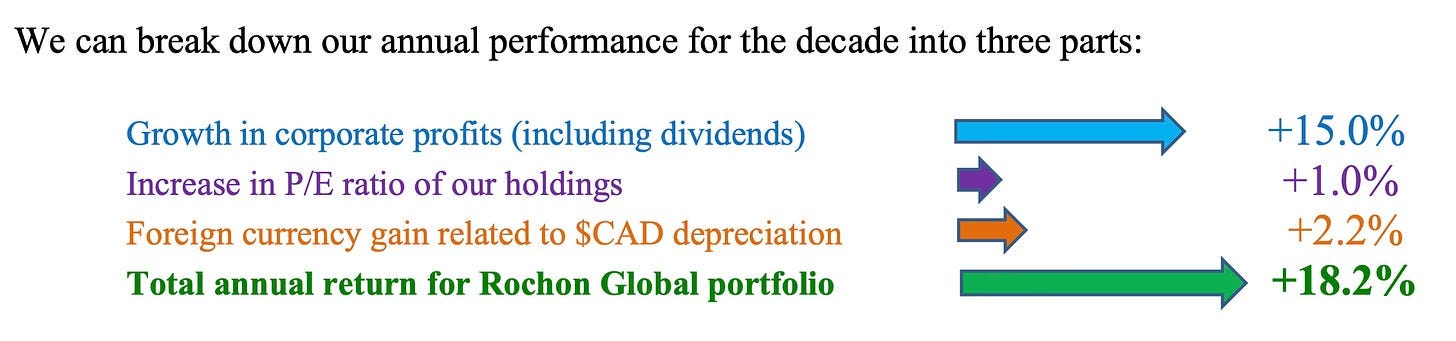

As shown in the picture below, much of Rochon’s performance also came from the growth in the profits of the companies in his portfolio. Over the long term, owning stocks of above-average companies is crucial for investment success. Why is this important? If you invest in companies that can increase EPS by more than 10% per year on average, your overall portfolio is expected to generate similar annual returns. Warren Buffett once said, “Investing is simple, but not easy.” And (of course) he’s right.

7. What Rochon Avoids in Investments

Maybe even more important is what Rochon stays away from, what are the things he avoids? It was the great Charlie Munger who said: “Invert, always invert.” Sometimes knowing what you don’t want helps you out tremendously. Don’t start thinking about your perfect day, start thinking about what you really don’t want to do and go from there. Alright, here are the things I’ve found that Rochon avoids:

Commodity-Like Products (2004): Rochon avoids companies that sell commodity-like products or services. He prefers businesses where "knowledge" and "brand" are the most important assets, as these factors make the companies less dependent on external resources like oil or steel. No one ever asks, “I want a Coke only if it comes in an Alcoa aluminium can.”

Unpredictable Industries (2007): Investing in new, rapidly growing industries (like solar in 2007 or the internet in 1997) is risky due to high market valuations and uncertainty about which companies will emerge as winners.

Holding Too Much Cash (2009): Rochon avoids holding significant amounts of cash, especially during market downturns. As he stated in 2009, “There is little use having all this liquidity if you wait for an even lower level to buy into the market”. He believes in the resilience of capitalism and the rewards of holding onto shares through tough times.

Energy Sector (2012, 2014): Companies directly dependent on the oil price are challenging to evaluate and fall outside his circle of competence. Instead, he looks for opportunities to benefit indirectly from energy trends without taking on the risks. This comes back to commodity-like products. It’s too difficult, maybe close to impossible, to make the right estimates for future earnings, competitive status and thus which price to pay.

High-Profile Companies (2015): In 22.5 years of portfolio management, Rochon never liked to own companies that are in the headlines of newspapers. He likes “low-profile companies”.

Political Influence (2016): He believes investing is about owning businesses, not betting on political trends. Good companies create unique products and services that survive political uncertainties. I loved this sentence of Rochon: “Political trends pass but good companies endure.”

Natural Resources (2017): It's difficult to have a competitive advantage in the natural resources sector, so Rochon steers clear of these companies.

Using Margin (2020): Rochon avoids using margin. Anything is possible in the world of financial markets in the short term (oil trading negative in 2020). Using margin always carrier a small probability of disaster. Even if the odds are 0.01% of losing all your capital, why take such a chance?

Unprofitable Companies (2022): He avoids investing in unprofitable companies because, in a bear market, there is no floor to their valuation, leading to sharp declines. He emphasizes the importance of a margin of safety when valuing companies, taking Cisco in 2000 as an example (trading at 120 times EPS).

In his Talk at Google, François Rochon shared three key things you should avoid if you want to outperform the market:

Thinking Short-Term: Rochon emphasized that to beat the market, you can't think like everyone else. Most investors and the industry focus on the short term. If you do the same, you'll likely get the same mediocre results.

Owning Too Many Companies: Rochon pointed out that having a large number of stocks makes it hard to stand out from the market index. This means you'll probably just mirror the market's performance, not beat it.

Believing You're Smarter: Lastly, Rochon warned against the arrogance of thinking you can outsmart everyone and predict the market. This mindset often leads to poor decisions and underperformance.

8. When Does Rochon Sell an Investment?

Francois Rochon, like Philip Fisher, wants to research and buy so well that he never has to sell. However, he acknowledges the importance of being rational and not letting emotions mix with stocks. Here are the key reasons and situations when Rochon decides it's time to sell an investment:

Better Opportunity: If a new company is more undervalued than a current holding and of the same or better quality in terms of growth prospects, management, or competitive advantage, Rochon will sell to buy a 20-cent dollar instead of a 50-cent dollar.

Example (2010): During the financial crisis of 2008-09, Rochon sold more conservative holdings like Wal-Mart or Johnson & Johnson, which hadn't declined as much as the market, to buy undervalued quality names like Google. This is also because Rochon is (almost) always 100% invested.

In his 2013 letter, Rochon even called it a mistake that he didn’t sell more of his “blue chips” like Johnson & Johnson to cash in and buy more of the better opportunities out there (higher quality with better prospects).

Growth Slowdown (2001): When a company can no longer meet Rochon’s objectives of 12-14% EPS growth, it could be time to sell.

Example: Rochon sold Fastenal when its growth rate declined and it seemed fairly valued relative to other securities in his portfolio.

Increased Risk: If the inherent risk of the company becomes too high, Rochon will sell.

High Market Valuation (2002): When the market valuation of a company becomes too high, it could be a signal to sell. This is a difficult one though, because you also don’t want to sell out of winners purely because they are overvalued at the moment. I think it needs to be quite extreme and you need another place to invest your money.

Key Management Changes (2002): If an important manager, probably the CEO or CFO, leaves the company, it might be time to sell.

9. The Power of Humility, Rationality, Patience and Positivity

Rochon often talks about the personal traits an investor needs to be successful in his letters. Four traits stand out, and I’ve listed them along with their importance for you: humility, rationality, patience, and positivity.

Humility

Don’t Predict: He admits that he cannot predict macroeconomic events, so he believes in always staying invested in the stock market.

Know your limits: Knowing your limits, also known as your circle of competence, is crucial for making sure you are not investing in something that is actually too hard for you to make assumptions about.

Learn from Mistakes: Rochon is always learning from his mistakes by recognizing them and striving for improvement.

Balancing Confidence and Humility: You need a good balance between self-confidence and humility. Confidence is needed for good judgment and patience, but humility to recognize what you don’t know and to own up to mistakes (2001).

Stoicism towards Performance: You should celebrate successes with humility. Rochon has a stoic attitude towards portfolio performance, no matter whether it is good or bad (2014).

Charlie Munger once said that Buffett’s greatest strength is his humility (2022).

Rationality

Avoid Comparisons: Rochon tries not to be affected when others make more money in stocks.

Ignore the Short-Term: Rochon strives to remain unaffected by short-term stock market quotations, maintaining a long-term perspective.

Accept Uncertainty: Rochon accepts that he doesn’t know the future and that predicting it is impossible. Instead, he focuses on controlling his own investment process.

Using the Market to Your Advantage: Rochon believes the stock market exists to serve investors, not guide them. Success comes from good temperament towards market quotations, especially during difficult times like 2008-09, recognizing that short-term prices are not always economic reality.

Patience

Good Attitude While Waiting: Patience isn't just waiting; it's about maintaining a good attitude while waiting. Focus on the company's performance, not the stock price or macroeconomic situation.

Avoiding Stubbornness: Patience is not the same as stubbornness or denial. Let me explain this by the “boiling a frog analogy”. In order to cook a frog, you cannot throw it in boiling water because it will jump out. You throw the frog in cold water and slowly rise the temperature until it boils. In investing, don't hold onto a deteriorating investment just to avoid selling at a loss. Recognize whether you're really making a mistake or if you can hold onto it because it’s a temporary issue. At least make sure you’re not “cooked like a frog”.

Long-Term Requires Patience: Rochon always states that in the long run, a portfolio's return is primarily driven by the intrinsic value increase of the companies owned. In order to benefit from these returns over the long term, you need patience.

Positivity

Positivity during Dark Times (2010): During the 2008/2009 crisis, people were saying that this would be the end of capitalism. Today, 15 years later, we know that that’s not true. This resilience highlights the importance of facing challenges with positivity. Rochon’s confidence in human potential to solve problems and come out stronger is worth a lot, especially during tough times.

Ignore Negative Media Outlets (2012 and 2019): Media outlets often present crises and economic worries, spreading bad news quickly, prompting many investors to sell. All the while, a lot of positive stuff is also going on in the world. Rochon emphasizes staying positive and focusing on long-term trends and good news, which often goes unnoticed (2012). For instance, in 2019, the US produced more electricity from renewable energy than from coal, a significant environmental achievement that was largely ignored by social media. Rochon highlights that bad news tends to dominate the media, but recognizing progress is crucial. It is vital to stay optimistic. As Rochon said in 2021, “Over the centuries, nothing has ever been built with pessimism.”

10. The Rule of Three

In 2002, Francois Rochon introduced the Rule of Three:

One year out of three, the market will drop by more than 10%.

One stock out of three that we buy will be somewhat disappointing.

One year out of three, we will underperform the indexes.

There’s no scientific basis for this rule, but it’s psychologically useful. Understanding this rule helps us stay calm during market storms. By accepting in advance that tough years will come, when our style or our companies are out of favor (sometimes for no reason), and that stock mistakes are a part of investing, we are better prepared when they happen. This mindset helps us act more rationally in challenging times. While it’s not always easy, we try to remain unaffected by short-term results, both good and bad.

Keep in mind that the Rule of Three is not linear. You might have three good years in a row and then underperform for two or three years. For example, John Maynard Keynes underperformed in the first three years and six out of 18 years, but ultimately outperformed by 10% annually in the end.

Rochon’s US portfolio underperformed the market in 2016, 2017, and 2018. In 2017, after two years of underperformance, he remarked: “The Rochon US Portfolio underperformed the S&P 500 on eight occasions (or 33% of the time) over 24 years. This is very much in line with our ‘Rule of Three’ where we anticipate underperforming the indices at least one year out of three on average…”

11. Crises Create Opportunities

Recessions are part of our capitalist system. That’s why it’s better to take advantage of these inevitable periods. How?

Increase Market Share: Weaker competitors tend to fold during recessions or at least lose market share to better managed companies (like the ones Rochon owns). Thus, Rochon looks for businesses that should survive these kinds of periods and perhaps even increase their market share as weaker competitors go under (2001, 2005).

Lower Stock Prices: Temporary stock market declines (like during recessions) create opportunities to acquire more shares of good companies (2005). As we all know, it’s better to buy in rainy days than in sunny days. In recessions and other crises, many investors will sell their stocks at any price thinking that never again will the blue sky return (2001). Keep in mind, some people will waiting “for prices to go even lower”. Start buying when you think the price is right, because it is futile to try and predict these purchases (2009).

So, don’t fear market corrections but acknowledge right from the start that you will go through them many times in your investing career. Try to benefit from them as much as you can (2002). You could even keep old articles of depressive times of the stock market to remember that eventually it will turn out okay (2003). If you own businesses with great business models, strong balance sheets and run by competent and honest managers, then chances are that they will be better off. It’s not that difficult!

12. The Podium of Errors

François Rochon believes in learning from mistakes, inspired by Warren Buffett’s “Mistake du Jour”. He stresses the importance of humility and honesty in investing, which means you should admit your mistakes to stay humble and even better, learn from them!

After going through all his mistakes, it's clear that Rochon believes his biggest blunders were the ones where he didn’t act—missing out on strong stocks he knew had potential. Some big examples are:

Starbucks (2005)

Mastercard (2008)

Google (2010)

Despite recognizing their potential, he missed these opportunities. Other mistakes he made were selling too soon, saying that he needed to be more patient.

My Favorite Mistake from Rochon (Visa)

Rochon calls it a mistake to have only bought Visa after a price drop due to the Durbin reform. He initially thought 23x earnings was too expensive, but after a 25% drop, he invested. He later realized that even at 23x earnings, it would have been a great investment, tripling the money in five years. He’s critical and rational enough to call this a mistake, showing his commitment to self-improvement (2015).

13. The Flavor of the Day

François Rochon cautions against investing in the "Flavor of the Day," or the fashionable investment trend of the moment. These trends can be misleading and often carry hidden risks. Rochon has a lot of experience in the markets and said this in 2005:

“It is quite amazing to hear today the same arguments for investing in oil that we heard about technology stocks only six years ago. It’s the same song, the same jingle but with different couplets.”

Some of the flavors of the days he talked about are technology stocks (1999-2000), oil (2005), treasury bills (2008) and cryptocurrencies together with meme stocks (2022). Be aware of fashion in investing.

14. Why Invest in Stocks Instead of Gold, Treasuries (and Crypto)

Stocks outperform gold and treasuries simply because businesses create value. It’s because businesses innovate, creating products, technologies, medicines, and services that improve our lives and generate wealth. Owning an economic stake in these businesses is a genuine source of wealth creation, unlike holding gold in a safe, which doesn't produce cash flows and is of little worth to society. The same could be said about cryptocurrencies. They might have some value to the world, but they don’t improve our lives as much as innovative products do. They certainly don’t gush out cash the way quality businesses do.

If you don’t believe Rochon, the legendary Charlie Munger also has no interest in gold:

“I don’t have the slightest interest in gold. I like to understand what works and what doesn’t in human systems. To me that’s not optional; that’s a moral obligation. If you’re capable of understanding the world, you have a moral obligation to become rational. And I don’t see how you become rational hoarding gold.”

Or in crypto, saying it’s “an investment in nothing” and calling it maybe even worse than that:

"I certainly didn't invest in crypto. I'm proud of the fact that I've avoided it. It's like some venereal disease or something. I just regard it as beneath contempt. Some people think it's modernity, and they welcome a currency that's so useful in extortions and kidnappings, tax evasion and so on. I wish it had been banned immediately. I admire the Chinese for banning it. I think they were right and we have been wrong to allow it."

15. Why You Shouldn’t Predict The Market

Timing the market is bad idea for several reasons. While stocks are the best asset class in the long run, most investors still fail to make money from them. Why? High fees and poor timing. Many investors buy high and sell low, trying to optimize their market entries and exits better than others, but end up doing the opposite.

As Charlie Munger once said, “90% of drivers believe they are better than the average!” Similarly, most investors think they can outsmart the market. But market corrections are part of stock investing and the price you pay for higher returns, as Peter Lynch pointed out. Stay invested in companies that meet your criteria, and don’t wait for the “perfect” time to buy shares. You need to be humble towards the market (2003).

Rochon illustrates his point with a comparison of the average returns for the S&P 500, stock mutual funds, and the holders of these funds over a 20-year period (1985-2005):

Annual return of the S&P 500: 12%

Average return of stock mutual funds: 9%

Average return of the holders of these funds: 4%

How is that possible? The difference between the S&P 500 and mutual funds is due to the costs associated with mutual funds. But the big drop in returns for holders is because investors tend to buy and sell their mutual funds at the wrong times. They buy what has recently gone up and sell what hasn't. They base their decisions on short-term market quotes rather than intrinsic value analysis. This behavior is what leads to such low returns (2006).

In summary, after nearly three decades of investing, Rochon believes the biggest mistake investors make is trying to predict financial markets. Waiting for the "right" time to buy or sell, or waiting for more clarity, often backfires. Historically, US companies grow profits by 6-7% annually and pay a 2% dividend, generating an 8-9% annual return. Of course, over the decades, there are market crises and drastic drops, so maintaining a long-term perspective is crucial. However, in order to succeed you should avoid market predictions, stay invested in solid companies, and focus on intrinsic value.

So, what should I answer when someone asks me: “Is this the right time to invest in the stock market?”

The top lesson to remember is that even the best stock selection strategy fails if you try to predict the market. Trying to time the market is a big mistake, yet many investors keep doing it despite all the evidence against it. They often say things like, "The market is too expensive; we should get out temporarily," or "It's not a good time to invest." These reasons change every year, but the mistake remains the same: missing out on owning quality companies because of temporary macroeconomic or political events (2023).

The question of whether it's the right time to invest is common. However, trying to predict market movements is pointless. The key to stock market success is simply being invested. So, the answer is clear: it's always a good time to be in the stock market if you're in it for the long haul.

Constantly questioning your investment timing can lead to bad behaviors. What kind? Buying only during bull markets chasing high returns, or selling during bear markets out of fear. This behavior, known as the “behavioral penalty,” causes equity funds to underperform the S&P 500 by about 4%. As we saw, investors buy and sell at the wrong times, leading to poor results (2014).

In 2021, François Rochon revisited this question: “Is this the right time to invest in the stock market?” He referenced a study showing that from 1990 to 2020, US equity fund holders achieved an annual return of 6.24%, while the S&P 500 returned 10.7%. This 4.46% gap isn’t because of management fees alone. It’s mainly due to investors’ poor timing—constantly switching between stocks and bonds at the wrong times.

So, what's the solution? Stop trying to predict the stock market! This is especially important during market declines or crises. Rochon decided to always stay 100% invested, focusing on finding high-quality companies instead of timing the market (2021).

In essence, the best strategy is to (stay) invest(ed) and focus on the long term. This way, you avoid the pitfalls of poor market timing and benefit from the overall growth of the market.

16. The Missing Gene Hypothesis

François Rochon talks about the “Missing Gene Hypothesis” to explain why few market participants achieve superior performance. He emphasizes the importance of having a good attitude towards market fluctuations. According to Rochon, those rare investors who consistently outperform the market over a long period might have something others lack. In reality, they are missing something most people have: the hypothetical “tribal gene.”

The "tribal gene" is a survival instinct that makes most people follow the herd. From Rochon's observations, it seems that some individuals are immune to this instinct. They can go left when the tribe goes right, essentially missing the “tribal gene.” It's difficult to determine how many people lack this gene, but it's certainly a minority.

Warren Buffett acknowledged the significance of this concept many decades ago with his famous advice: “To succeed in the market, be fearful when others are greedy and greedy when others are fearful” (2013).

In essence, the ability to think independently and resist the herd mentality is a key trait of successful investors. This missing gene enables them to make decisions based on rational analysis rather than emotional reactions to market movements.

Being able to do nothing when almost everyone else is doing something is difficult. As is so often the case, following the herd in the financial markets is rarely a winning strategy (2016). This picture, which hangs in the office of Bruce Flatt, illustrates it perfectly.

Wow, that was quite a lot of information. If you made it to the end, seriously well done. I don’t expect you to remember all of it in one sitting, of course. However, I didn't want to miss out on sharing a lot of Rochon’s wisdom on important investing topics. You can use this blog as a starting point whenever you need to revisit Francois Rochon’s insights. I'll end with one of my favorite pieces of wisdom from Rochon about “going in the middle road”.

Going in the Middle Road

Ben Graham wrote in 1958: “Medius tutissimus ibis: you will go safer in the middle road,” referencing the Roman story of Phaeton and Phoebus about the Greek god flying across the sky in his solar chariot. Phaeton, given permission to drive his father’s solar chariot, was warned to stay in the middle of the trajectory—too low and he would ignite the Earth, too high and he would set the heavens on fire. Ignoring this advice, Phaeton lost control and crashed, nearly setting the world on fire. At Giverny Capital, Rochon embraces a similar balanced approach:

Open Mind vs Independent Thinking: We have an open mind but, at the same time, an independence of thought. We try to maintain a balance between humility and confidence in our judgment.

High vs Low Growth: We like to invest in companies that are growing quickly but not too quickly, knowing the dangers of growing too fast or falling prey to shifting trends.

High vs Low Debt: We understand the economic benefits of using some debt, but we stay away from companies that use it too aggressively.

New vs Old: We can invest in companies related to new technologies, but not in their very beginnings. We want to ensure that the business model is sound and sustainable.

High vs Low P/E: We are willing to pay a higher P/E multiple than when we began investing, but there is a limit we are not ready to cross.

Patient vs Stubborn: We are patient but also know that there is a difference between being patient and being stubborn.

Rochon has achieved amazing long-term results, but he always wanted to reach them without taking on inappropriate amounts of risk. He wants to be a good steward of his partners capital. By constantly keeping in mind the wisdom of Phoebus is to have a lighthouse guiding the path to enrichment in the stock market while remaining cautious (2018).

Thank you for joining me on this journey through Francois Rochon's annual letters. I hope you found it as enlightening as I did. If you'd like to discuss anything, just message me on Substack or on X (@MindfulCompound). I’d love to hear from you! Thanks again and see you next time.

Luuk

-

Disclaimer: This analysis is not intended as investment advice but as a personal opinion and can serve as a supplement to your own research. The information is explicitly not intended as advice to buy or sell certain securities or securities products, but to provide an overview of the underlying company/companies. You are solely responsible for the decisions you make regarding your investments.

Another great summary. Such a nice treat for me to read first thing in the morning! Thanks for the effort.

Great insights