A Deep Dive into Nedap (NEDAP.AS)

Exploring the Quality, Risks, and Future Potential of Dutch Tech Small-Cap Nedap

Let me start by saying that I’m really looking forward to writing down all my thoughts on this great Dutch small-cap called Nedap. Why is that? Well, I think it’s the company I feel most connected to. That could be a good thing (not saying goodbye too quickly and being more likely to ride out downturns) but also a bad thing (not letting go when you probably should). At the end of 2024, I went to the company’s Capital Markets Day (CMD) with a buddy of mine. We spoke with some key personnel, got a tour of their HQ, and learned about their latest innovations. It was a really fun learning experience, and I have to admit—being charmed by charismatic CEOs is definitely a thing.

My investment philosophy revolves around identifying high-quality businesses that can consistently build value over the long term. I seek out companies with a strong competitive advantage, significant growth potential, a robust balance sheet, and excellent returns on their invested capital. Equally important is a management team committed to the long game and aligned with shareholder interests. While this strategy might sound straightforward, finding these companies isn’t that easy. Let’s explore whether Nedap meets these criteria.

For full disclosure, I should mention that Nedap makes up around 15% of my portfolio. This means I am (not just might be, but surely am) susceptible to cognitive biases, such as confirmation bias, wishful thinking, and probably overconfidence bias. I try to stay aware of these biases and maintain a nuanced perspective.

As I did with my deep dives of Interactive Brokers and Dino Polska (make sure to check them out as well), I’ll take a structured approach to evaluating Nedap by addressing these key questions:

What does Nedap do?

Is it a high-quality business?

Is it managed by a capable and shareholder-aligned team?

Is it fairly valued?

What are the risks?

1. What does Nedap do?

Nedap is a technology company that creates high-quality, innovative solutions. Before I dive deeper into these solutions, I think this quote from their CMD perfectly sums up why they exist:

“At Nedap, we are passionate about technology and how it can help people to become more successful and happier in their professional lives. This, what we call Technology for Life, is our purpose and drives us in everything we do.”

Technology for Life, indeed. I like companies with a clear vision of making the world a better place, but I love companies that combine that vision with making solid profits. That’s how all stakeholders win I guess! So, what does Technology for Life mean in practice? Let’s start by taking a quick look at their history, as they’ve been in transformation mode for some years now.

There are a couple of points I’d like to highlight in Nedap’s timeline. The first is when Nedap was listed on the Amsterdam Stock Exchange in 1947, just after the Second World War. They quickly became one of the global specialists in the development of electronics, thanks to the shift from electromechanics to electronics. Then, in the year 2000, they began transitioning from hardware to software, and by 2018, they completed yet another transformation—this time moving from a fairly asset-heavy business model to an asset-light one!

If there’s one thing to remember: Nedap has been through a lot, and they’ve consistently adapted to try and stay ahead of the curve. That said, I believe there’s something truly special about their latest (and still ongoing) transformation into a SaaS player—but more on that later.

Now onto Nedap’s ways of making money. They operate in four main market segments. Well, technically, they have seven, but three of those aren’t worth mentioning. Even Nedap acknowledges this, as they’re in the process of winding down those segments due to their inability to scale them to the right size. In recent years, Nedap has been focusing on getting their priorities straight. These four markets now have their full attention:

Healthcare (~30% of revenue)

Livestock Management (~30% of revenue)

Retail (~20% of revenue)

Security Management (~20% of revenue)

Healthcare

I’ll start with Nedap’s Healthcare business because I believe this is where the real magic lies. That’s why this section will get a bit more attention compared to the others. Dutch healthcare has a lot of different markets, and without going into too much detail for the sake of time, I’d like to talk about Nedap’s product in this segment combined with the markets in healthcare, so you can better understand Nedap’s market position in the whole Dutch healthcare landscape, their growth opportunities and more.

All right, so Nedap provides software services that assist Dutch healthcare institutions with planning, record-keeping, and administration—essentially ensuring that healthcare professionals can spend more time on care and less on paperwork. This is becoming increasingly important with the aging population and the growing labor shortages that are shaping the future of the Dutch healthcare industry:

These (concerning) trends call for action: they drive a growing need for greater efficiency—essentially, more technology! And this is precisely where Nedap steps in with four key products:

Nedap Ons

MediKIT

Caren

Luna

I’ll start by briefly introducing their four products, then dive deeper into each one as we discuss the markets they operate in within Dutch healthcare and their respective market shares and opportunities.

Nedap Ons

Nedap Ons is the flagship product and main revenue driver. Over 1,900 organizations rely on this Software-as-a-Service Electronic Health Record system. Essentially, it’s a cloud-based platform that helps healthcare providers manage patient records, streamline workflows, and deliver care more efficiently. The retention rate is remarkable—99%—and recurring revenues make it a reliable source of income. At the annual meeting, their CCO, Rob Schuurman, even mentioned he couldn’t recall any customers leaving. Nedap Ons is used across four different healthcare markets—more on those below.

MediKIT

With the recent acquisition of MediKIT, a general practitioners (GP) information system, Nedap is now making strides in the GP market. MediKIT is a specialized software solution for GPs that not only streamlines administrative tasks and patient data management, but also includes a unique feature that allows GPs to record consultations. Patients can then revisit the conversation through a transcript on the platform, offering clarity that’s often lacking in traditional, hard-to-read doctor’s notes. The fact that MediKIT’s founder, Pieter van Tiel—a former GP—remains involved as part of the Nedap team further reinforces the strength and credibility of this project.

Caren

Caren is a digital health environment that gives clients and patients more control over their care. By providing a clear overview of care plans, tasks, and information, it helps families and caregivers stay organized. And it’s working because 380,000 patients and informal caregivers use Caren every month. Although Nedap does not generate revenue directly from Caren, it is offered as an additional service to all care organizations using Nedap Ons. This shows Nedap’s commitment to improving Dutch healthcare by empowering clients and their families to take a more active role in managing care.

Luna

Luna is a hardware product: a digital day calendar that helps people with cognitive challenges structure their daily lives. By simply showing what the day will look like, Nedap Luna gives them the confidence to act independently. Care organizations purchase it to reduce care time—approximately 4 hours per client, per month. This effectiveness is why virtually all health insurers cover Nedap Luna. This is what it looks like:

Now, let’s take a look at the different submarkets within the Dutch healthcare sector, which is quite diverse. Apologies if I’m missing some (important) nuances, but roughly speaking, the market can be divided into six segments. I’ll go over them shortly and also highlight Nedap’s position and growth opportunities in each. To start, take a quick glance at this graph Nedap shared, which shows their market shares in five of these segments. All the market share data in this blog comes from an independent source (M&I Partners, you can find this data on their website as well). As you can see, Nedap has a very strong presence in elderly care, disability care (both part of long-term care) and domestic help, while mental healthcare and the GP market are set up nicely for future growth.

Okay, let’s get into the Dutch healthcare market segments and Nedap’s role in them:

1) Primary care - MediKIT (5% market share):

Primary care includes GPs, dentists, physiotherapists, and pharmacies - basically, the first line of contact for most patients. Nedap’s MediKIT product is designed for GPs, and the company is putting significant effort into gaining market share. With a TAM of approximately 70 million euros and still growing, this segment presents a substantial opportunity. Currently, MediKIT holds a modest 5% market share, but it’s early days, and there’s plenty of room for growth. The primary care market is comparable in size to the elderly care segment, and it could eventually deliver tens of millions in revenue. While Nedap acknowledges an okay competitor in this space, let’s see if they can win over some customers the coming years!

2) Hospitals and specialist care - no product:

Hospitals are the main providers of secondary and tertiary care, providing more complex treatments and surgeries. However, this market is already dominated by established players like ChipSoft, and Nedap isn’t active here. As you can see, the software market in hospitals shows a clear winner-takes-all dynamic, which is a pretty interesting phenomenon for Nedap and its markets too.

3) Long-term and elderly care - Nedap Ons (50% and 60% market share) & Luna:

This segment includes nursing homes, home care organizations, and disability care (GHZ). With an aging population, long-term care is growing as it provides sustained support for those who can no longer live independently. Nedap leads these segments with their Nedap Ons product, holding a 60% market share in elderly care and 50% in disability care (these two markets are combined in the graph below showing all the market shares). As you can see, in these segments Nedap is in a winning position. At the CMD, management even mentioned seeing room for further market share growth. Besides, if they simply maintain their share in this growing market, revenues will continue to rise. Given how the software market in other healthcare areas tends to consolidate—much like the hospital market in the graph above—it’s not hard to imagine Nedap’s share increasing to 70% or higher over time.

Will they be able to fight off competition or even increase market share? Well, if you take a look at the graph below; you’ll see that competitors include SDB Groep, PinkRoccade, Ecare, Tenzinger and Adapcare:

SDB Groep is owned by the private equity firm Main Capital Partners. I believe their financial backing isn’t necessarily focused on improving and developing Dutch healthcare, but rather on increasing margins (and raising prices), possibly aiming for a profitable exit in a few years (like PE firms normally do). While it appears that they gained market share with six new customers, this is misleading, as the increase came from their acquisition of Avinty (which had seven customers), meaning they actually lost a customer during the process.

PinkRoccade is part of TSS, a large European provider of business software solutions (and a subsidiary of Constellation Software). Reportedly, internally PinkRoccade had a “strategy” of reducing client losses to Nedap, but losing five customers shows that this strategy hasn’t worked as planned.

Ecare is part of Visma Group, another large European provider of business software solutions. Visma Group looks like a well-run company, which TSS (PinkRoccade) is as well. They did grow a little but not taking market share of Nedap.

For Tenzinger and Adapcare, I couldn’t find ownership details. However, a source at Tenzinger mentioned that Nedap’s extensive client base often gives potential customers confidence in their reliability, which makes it pretty difficult for them to compete. Tenzinger’s loss of four customers reflects this struggle. As for Adapcare, their lack of growth in 2024 speaks volumes.

In contrast, Nedap employs around 130 developers and is genuinely focused on improving Dutch healthcare—Caren is a clear example of this commitment. Additionally, Nedap’s Dutch ownership avoids any political concerns about foreign control over public digital infrastructure. Of course, the numbers already demonstrate that Nedap is leading, and the competitive factors mentioned above don’t suggest that their rivals will significantly shift the market in their favor, especially given the winner-takes-all dynamic.

4) Mental health (GGZ) - Nedap Ons (20% market share):

Mental health care ranges from short-term counseling to intensive psychiatric care. With increased awareness of mental health issues, this segment is becoming a key area for innovation and growth. Nedap entered this market in 2021 and has quickly reached a 20% market share with its Nedap Ons solution. At the CMD, management emphasized that growing this share remains a top priority, alongside their efforts in the GP market.

Although the path to growth may take time—given that organizations rarely switch providers frequently—Nedap’s track record of quality could ultimately help them capture more market share. Current data from November 2024 suggests they are well-positioned for expansion.

However, competitors present a mixed picture. SDB Groep’s growth here is all attributed to their acquisition of Avinty rather than organic gains, which means they didn’t grow organically. However, Nedap didn’t either. PinkRoccade is struggling which is reflected in this market too with the loss of a customer. Meanwhile, Adapcare is showing notable growth (not sure whether that’s through acquisition or organically) in this market, making them a player to watch here.

On a positive note, Nedap’s patient portal, Caren, is the most used in the mental health market, with a 22% market share, followed by SDB Groep’s Karify at 14%. This strong adoption is an indicator that Nedap is reinforcing its position within the broader care network.

5) Nursing, home and domestic care (VVT) - Nedap Ons (50% market share) & Luna:

Home care helps people remain in their own homes while receiving the assistance they need, reducing the pressure on institutional care. This segment overlaps with elderly and long-term care, and Nedap has a strong presence here thanks to its Nedap Ons product. In addition, Nedap is actively working to scale its Luna product within this space. While finding detailed market data for this specific segment is difficult, I believe the overlap with long-term and elderly care suggests that the trends I discussed earlier in the blog hold true here as well. Nedap continues to be a key player in this area.

6) Youth care - no product:

Youth care focuses on helping children, teenagers, and their families deal with challenges like mental health, development, or safety issues. It’s a sector Nedap hasn’t stepped into yet, but at their CMD, they mentioned it’s part of their plan to explore this area. Right now, youth care organizations aren’t really shopping for new software—there’s not much competition, just a few players holding the space. That said, there’s a big need for better software tools according to M&I Partners. SDB Groep, backed by private equity, is the current leader here, but I think Nedap could (easily) take them on with their proven quality product(s) and talented team of more than a 100 developers. Plus, since the whole software game in this industry is still in its early days, I think Nedap has plenty of time to jump in and take some share.

In the Dutch healthcare system there are, of course, other areas like public health initiatives, vaccination programs, and the pharmaceutical sector. But I believe the main markets relevant for this deep dive are the ones mentioned above, and Nedap is well-positioned to earn the big bucks when consolidation comes.

All in all, while some of Nedap’s revenue streams like Livestock Management or Retail (which I’ll cover later) may see revenue fluctuations in tough market conditions, the Healthcare division continues to show solid growth. The reliance on software subscriptions for their customers means a near-perfect retention rate (99%), annual price increases, and steady revenue—even if regulatory changes temporarily limit new customer acquisition. In fact, 60% of their open positions are in Healthcare, highlighting its strong momentum. With a mix of new customers and expanding services for existing clients, this division is poised for consistent growth over the next decade.

Livestock Management

Now onto Nedap’s second market: Livestock Management. While I’ve focused more on Healthcare as the gem of my investment thesis, this segment also deserves attention—especially for the way it integrates technology to improve dairy farming.

Nedap’s mission in this market is simple yet impactful: optimize the lives of dairy cows and the farmers who care for them. With over 30,000 farms and 5.5 million cows already using Nedap’s systems, the company provides quality solutions that improve herd health, increase productivity, and boost farm profitability. Here's how they do it:

CowControl: Think of this as wearable tech for cows, almost like a Fitbit, Garmin or Apple Watch for cows (see picture below)! Using smart tags, farmers can monitor each cow’s activity, eating habits, and fertility in real time. Alerts about a sick or fertile cow mean farmers can act immediately, keeping herds healthier and more productive.

FarmControl: This solution integrates data from CowControl and other sources, offering a bird’s-eye view of farm operations. Farmers can fine-tune feeding schedules, workflows, and overall efficiency with this holistic approach.

MilkingControl: MilkingControl optimizes the milking process, making it faster, gentler, and more efficient. The system ensures milk quality while keeping stress levels low for cows.

In 2024, Nedap introduced Vision, a groundbreaking tool that uses cameras and AI to detect early signs of lameness—a problem affecting 25% of dairy cows. By catching the issue early, Vision enhances animal welfare and farm productivity. It’s a great example of how innovation can serve both ethical and financial goals. Besides, it’s a great example of how Nedap leverages its global reach to upsell new technology to dairy farmers.

The Dairy (Tech) Market

Global milk demand is slowly creeping up (1% CAGR through 2050), but the real growth lies in the adoption of technology in dairy farming. Cow monitoring systems are projected to grow at an impressive 13% CAGR through 2028—a trend that aligns perfectly with Nedap’s core strengths.

With a 40% global market share (through CowControl and FarmControl) and partnerships that reach 75% of professional dairy farmers worldwide, Nedap is already the leader in this market. Their position is further bolstered by an expanding portfolio of innovations like Vision and a pioneering business model in the dairy industry: SmartTag-as-a-Service. Designed for large dairy farms with over 10,000 cows, this subscription-based model replaces high upfront costs with manageable monthly fees, making advanced monitoring technology more accessible globally and better suited to handle the cyclical nature of the Livestock market.

Despite this growth potential, 2024 was a challenging year for Nedap’s Livestock segment, which, as mentioned, is quite cyclical in nature. Declining milk prices and rising feed costs impacted revenues. Since Livestock still represents around 30% of Nedap’s revenues, these challenges also weighed on the company’s overall performance.

However, there are signs that market conditions are starting to improve. In the long term, Nedap is well-positioned to capture growth in the dairy tech market. Notably, at the CMD the CFO highlighted that Nedap actually gained market share during this downturn—a testament to its resilience. When the market recovers, Nedap is poised to emerge even stronger. This is the beauty of a quality company, and I really believe Nedap is a quality player in the growing world of dairy technology.

Retail

Let’s talk about the third market: Retail, one of Nedap’s most exciting markets—and one with massive potential. Ever walked into a store and wondered how they always seem to have your size in stock? Or why they sometimes don’t? Inventory management in retail is tough—manual counting takes forever, mistakes are common, and theft is an ongoing issue. Enter Nedap, a company that’s revolutionizing the way retailers track and protect their products.

Nedap’s RFID technology wirelessly tracks items in real-time, giving retailers an instant overview of their inventory across factories, warehouses, and stores. With their iD Cloud platform, brands like Uniqlo, Adidas, and On pay a monthly fee to track every item from production to checkout. The result? Inventory accuracy jumps from 70% to 98%, meaning shoppers are far more likely to find what they’re looking for (happier customers), and retailers benefit from increased sales.

Take their partnership with sports brand On, for example. They’re rolling out iD Cloud across factories, warehouses, distributors, and stores worldwide. The goal? To enable end-to-end tracking of each individual item, from production all the way to the final consumer.

At the CMD, Nedap showcased their innovation, and it was pretty impressive. If you've ever worked in retail and had to manually count products to check stock levels or figure out what needs restocking, you know how time-consuming and frustrating it can be. With Nedap’s solution, every product is tagged with RFID, allowing stores to scan their entire inventory within seconds. Honestly, it's a total game-changer if you ask me.

And it doesn’t stop at inventory tracking. Nedap’s latest innovation, iD Gate Pro, combines RFID with theft prevention, allowing stores to track stolen items without disrupting displays or requiring "tag-free zones." Retailers can now maximize sales space while keeping losses low.

With these innovations, Nedap has become the #1 RFID partner for fashion retailers in the U.S., helping brands improve efficiency, reduce shrinkage, and boost sales.

Growth Potential

Nedap sees significant growth opportunities for its iD Cloud platform, positioning itself as the market leader in RFID solutions across North America and Europe. Currently, Nedap holds a 35% market share, making it larger than its top three competitors combined.

Looking ahead, Nedap expects RFID market adoption to double within the next five years, with the highest growth projected among retailers with more than 1,000 stores. This segment alone accounts for around 50% of the total adoption potential, representing a major expansion opportunity.

Nedap should be able to connect 40,000 retail stores to its iD Cloud platform in the long run, a significant jump from the 10,000+ stores it had by the end of 2021. Ultimately, the company itself has set its sights on reaching a total of 100,000 stores, underscoring its ambitious growth plans.

With RFID becoming an essential tool for retail efficiency, Nedap is well-positioned to benefit from the rising demand and further solidify its leadership in the market.

Security Management

The fourth and final market of Nedap is Security Management—a segment where the company has been a global leader for nearly 50 years. Every day, over 50 million doors are opened using Nedap’s technology. Their security solutions, from access control systems to advanced identity management, are trusted by over 2,500 organizations across 83 countries, including 36% of the top 250 EU organizations. Major clients like Airbus, Unilever, the European Union, and Schiphol Airport rely on Nedap to secure their operations and ensure the smooth, safe flow of millions of people.

With such high-profile customers, the stakes are immense. Security must be flawless. One failure could have catastrophic consequences, so trust and reliability are non-negotiable. Nedap’s decades of experience have allowed them to develop innovative, scalable solutions that meet these demanding standards. Here’s a closer look at the three core offerings Nedap believes are key to its future growth:

1) Access control

Nedap’s access control solutions cater to a variety of organizational needs, from on-premise systems for maximum control and customization to cloud-based platforms that offer scalability and convenience.

AEOS (On-Premise solution)

AEOS (Access Event Operating System) is Nedap’s flagship on-premise platform, combining hardware and software to provide security for critical infrastructure. Think of it as giving you complete control over your organization’s doors. With features like wireless locks, video management, and biometric access, AEOS is regarded as “the gold standard” in the industry. It’s no surprise that over a quarter of multinationals headquartered in Europe use AEOS, including giants like Unilever and Schiphol Airport.

Access AtWork (Cloud-Native solution)

Nedap AccessAtWork, a SaaS platform, is all about making access control easier for businesses with multiple locations. It gives you one central place to manage everything, keeping security tight and making sure only the right people get in where they need to. Nedap launched this SaaS solution to address the needs of mid-sized businesses that may find on-premise solutions too costly. This cloud-based system offers an affordable way to upgrade outdated security systems with state-of-the-art technology. Unlike traditional access control, Access AtWork secures spaces rather than just doors, making it versatile and scalable for organizations of any size.

2) PIAM (or Pace)

PIAM (Physical Identity and Access Management) is a security solution from Nedap that helps large organizations manage access for thousands of cardholders. It leverages digital twin technology to create a virtual replica of the organization’s environment, enabling faster and more accurate mapping of critical buildings. This not only enhances security but also boosts operational efficiency.

One of PIAM’s standout features is its hardware-agnostic design. It works seamlessly with both Nedap systems and third-party equipment, offering organizations incredible flexibility. This is particularly valuable in an industry where switching costs are notoriously high. If a large customer feels their current provider isn’t keeping up with innovation (a situation that, I’ve heard, happens quite often in the security world), they can take a phased approach to transition.

For example, they can start by implementing Nedap’s PIAM software on their existing hardware. Then, when the time is right—perhaps during a renovation—they can fully switch over and invest in Nedap’s hardware for a complete, integrated solution. This phased strategy reduces the security risks that can arise when swapping out an entire system at once, which is a significant concern for large organizations.

Ultimately, PIAM not only bridges existing access control systems but also positions Nedap as a provider of innovative, high-quality security solutions. The challenge, of course, is for Nedap to continue proving that they are indeed the best choice for organizations seeking security and efficiency at the highest level.

Nedap’s innovative solutions like Access AtWork and PIAM are central to their growth strategy. These subscription-based models shift the focus from large upfront costs to recurring monthly fees, making advanced security more accessible, better suited for cyclical markets while increasing revenue per user.

The European security market is expected to grow by 5-7% annually, providing a solid foundation for long-term growth. Nedap’s mature client base (2,500+ organizations) is another advantage. With a retention rate exceeding 95%, they’ve built a level of trust and loyalty that’s hard to replicate. This retention isn’t just anecdotal; at the Capital Markets Day, the head of the Security segment revealed that fewer than 5% of customers leave Nedap Security. Despite its maturity, Nedap still sees growth potential in this market segment, particularly in regions like the Middle East, where their regional office allows them to focus fully on capturing market opportunities. High-profile clients such as Saudi Aramco underscore the quality and reliability of Nedap’s Security solutions.

In an industry as sensitive as security, I believe trust is more than a buzzword—it’s a real competitive advantage. Organizations like Schiphol and the European Union cannot afford even the smallest breach, making reliability and reputation paramount. Nedap’s longevity, customer loyalty, and proven track record position them as a trusted partner in this high-stakes market.

While Nedap’s Security segment is likely the company’s cash cow (I’ll get to that later), it still holds potential for growth, thanks to innovations like PIAM and Access AtWork. With a market that’s steadily growing and a strong foothold in high-profile organizations, Nedap’s Security Management division is well-positioned to maintain its leadership and drive long-term profitability.

Wrapping Up Nedap’s Four Markets

You might be thinking: “These markets are so different, wouldn’t it make more sense for Nedap to focus on just one or two?” Well, that’s what I thought at first, and luckily that exact question came up at the CMD, and the CEO had an interesting answer.

According to him, having diverse end markets is actually one of Nedap’s strengths. Why? Because it provides diversification. For example, Retail and Livestock can both be cyclical, but their peaks and troughs often offset each other, creating more stability for the company as a whole.

Another key point is Nedap’s expertise in RFID technology, which is used across all its markets. RFID is incredibly versatile, and being active in multiple sectors allows Nedap to apply this technology in different ways. The CEO also highlighted how Nedap’s experience with theft detection gates (hardware) in Retail, combined with their software knowledge from developing Nedap Ons in Healthcare, gave them a unique advantage. When the RFID market in Retail exploded, Nedap was already well-positioned to offer a full solution—hardware and software combined—something many competitors struggle to deliver.

But, as with any strategy, there’s a trade-off. When Nedap develops a hit product, like Nedap Ons in Healthcare, they only partially benefit because their focus is spread across multiple markets. This limits the potential upside for the company as a whole.

2. Is it a high-quality business?

Phew, that was quite the deep dive into what Nedap does! I know I could’ve kept it shorter, but hey, there are already plenty of quick-read blogs out there. I like to go into detail because it’s part of my own investment journey—and hopefully, some of you find it interesting and valuable too!

Now, onto the second question I ask myself. It’s a pretty open-ended one, and that’s intentional. Different companies have different traits that can make them high-quality, so I like leaving room for interpretation.

For me, one of the key traits of a high-quality business is the ability to sustain at least high single-digit revenue growth over many years. So, how does Nedap measure up? Over the past 10 years, revenue grew only 4,2%—not great, especially for a company positioned as “tech.”

But let’s dig a little deeper, because I think there’s a lot that’s been happening under the hood. While their old hardware division shrank, their software segment flourished—exactly the direction Nedap has been steering towards. Nedap moved from an inventor mindset to a more commercially focused approach, which is seen in the reduction of market segments (11 in 2007 and 7 in 2019 to now 4 key markets), a strong focus on R&D in these four markets (18% of revenue) and most importantly shifting from “one-time project payments to subscription-based models“, spreading revenue over time. This change impacts current revenue growth, making it look slower, but they should pave the way for faster and more sustainable growth in the years ahead. Let me explain this more looking at companies like Adobe, Autodesk and Oracle that went through a similar transition. What happened there? Revenue eventually took off as their subscription models gained traction. Nedap is on a comparable journey—so the question is, how long until we see that same kind of takeoff? Okay, let’s zoom in more on these examples.

Insights from Transitioning to a Subscription-Based (SaaS) Model

Before subscription became the norm in software, companies like Oracle operated under a very different sales model. Revenue streams were split into two categories:

License revenue – A large upfront fee for perpetual software licenses.

Maintenance and support revenue – An annual fee (typically ~20% of the license cost) for updates, upgrades, and technical support.

The big challenge with this model? License revenue was a one-time deal, while maintenance and support offered a recurring income. Over time, the latter became the dominant source of revenue. For instance, in 2021, Oracle generated $5.4 billion in license revenue but $19.8 billion from license support. However, neither of these revenue streams showed much growth by 2024, as Oracle shifted towards a subscription-based model.

When companies transition to subscriptions, everything gets consolidated into a single recurring fee. This includes the right to use the software, maintenance, and support services. The upside is a predictable and stable revenue stream, higher customer retention, and better long-term customer relationships. But here’s the kicker: the transition creates short-term pain.

Let’s break it down. Imagine a customer buys an Oracle software license for $100 upfront and pays $20 per year for maintenance. Over 10 years, Oracle earns $300. Now, if this same customer moves to a subscription model and pays $50 annually, Oracle earns less until year four. But by year 10, the cumulative revenue is 67% higher under the subscription model. It’s a win in the long run, but during the transition, revenue growth takes a hit, and the income statement looks less appealing.

Between 2012 and 2020, Oracle’s revenue grew by just 0.6% CAGR—partly due to this gradual shift. While it seemed slow, the groundwork they laid during that time has paid off as subscriptions have now become the industry standard.

Adobe did exactly the same thing. In FY12 (2012), Adobe relied heavily on one-time product sales, but by 2014 they started shifting to subscriptions. While their revenue initially dipped during the transition (2012 through 2015), it quickly gained momentum. Fast forward to FY24, and subscription revenue has soared to $20.5 billion, dwarfing the $1 billion they still generate from traditional product sales.

This shift didn’t just increase revenue—it also made Adobe’s income predictable and scalable, allowing them to grow their customer base and foster long-term relationships.

Finally, the same goes for Autodesk. Looking at their chart, you can see how their revenue composition shifted between 2016 and 2020. In 2016, Autodesk still relied heavily on perpetual license sales (other revenue) and maintenance fees, while subscription revenue was just a small slice of the pie.

By 2020, the story is completely different. Subscription revenue has skyrocketed, making up the bulk of their income, while perpetual license sales had almost disappeared. During this transition, Autodesk also experienced short-term revenue pressure, as seen in the lower total revenue in 2017 and stagnation in 2018 and 2019. This was due to the shift from large upfront payments to smaller recurring payments.

However, by 2020, the benefits of the subscription model became clear. Revenue rebounded, and recurring income provided more stability and predictability for the company. Just like Adobe and Oracle, Autodesk’s transition proves that while moving to a subscription model requires patience and investment, the long-term rewards can be transformative.

What This Means for Nedap

Looking at the chart, it’s clear that Nedap is in the midst of a similar transformation to a subscription-based model. By moving from one-time sales (non-recurring) to subscription-based revenue (recurring), they are spreading income over time instead of collecting large upfront payments. Remember Nedap’s solutions? Nedap Ons in Healthcare, iD Cloud in Retail, PIAM and Access AtWork in Security, and SmartTag-as-a-Service and Vision in Livestock Management—these are all recurring revenue streams that are turning the transition into a reality.

Like Oracle, Adobe and Autodesk, this transition puts pressure on short-term revenue growth, but the benefits shift—predictability, stability, and deeper customer relationships—can create a more robust business over the long haul. While the current numbers might not fully reflect the impact of this shift, the potential is clear.

Recurring revenue (orange bars) has been growing steadily (an impressive 17% CAGR). Meanwhile, non-recurring revenue remains stable but is no longer the primary growth driver. This suggest that Nedap is transitioning from one-time project payments and hardware sales (60% of revenue as of Q3 2024) to a more predictable and stable subscription-based model (40% of revenue as of Q3 2024 compared to 23% five years ago). Over time, recurring revenue is taking up a larger share of the total, pointing to Nedap’s strategic pivot.

The share of recurring revenue as a percentage of total revenue will only increase in the coming years, with recurring revenues growing much faster than non-recurring ones. Eventually, this steady growth will gradually pull total revenue growth higher. Thanks to its recurring income, Nedap is also becoming much more resilient to an economic downturn. Customers rely heavily on Nedap’s software, making it one of the last things they’d cut during a crisis.

So, based on revenue: is Nedap a high-quality business? Well, the results over the past 10 years don’t reflect that yet. But in a few years, with this ongoing transition? I think this potential is still unrecognized—and that’s exactly where the opportunity lies.

Competitive Advantage

I believe Nedap’s individual market groups do have a moat, even if it’s not on the same level as giants like Mastercard or Visa. An investor like Dev Kantesaria might overlook this one, but I think smaller, less discovered companies like Nedap can present great opportunities—especially if you can identify a hidden moat. Because it’s not just about the moat as it exists today; it’s about the trajectory—is it widening or shrinking? In Nedap’s case, I believe the moat is widening, which makes it compelling!

One of Nedap’s strongest examples of a moat is in the Healthcare segment, where switching costs are exceptionally high. Healthcare clients are particularly attractive—many of them are quasi-government organizations that are less price-sensitive and prefer stability over cost-cutting. This means they are unlikely to switch to a competitor, even if the alternative is slightly cheaper. These clients tend to be more loyal, and what’s more, they don’t go bankrupt. And that’s seen in the retention rate for Nedap’s software in Healthcare, which is 99%.

While switching costs in other market groups like Retail and Security are also considerable, they’re likely not as steep as in Healthcare. With retention rates of 98% and 95%, these software products are clearly fine as well. Regarding Healthcare and Retail, management mentioned that no clients have left for a competitor due to a better offering. I can imagine that, for Retail clients, it’s a total hassle to switch when you’re tracking your entire supply chain (or even part of it). Transitioning to another software provider would mean pausing critical operations, which isn’t the best scenario.

For Security, the stakes are equally high. In an industry like that, I do feel like Nedap’s 45 years of trustworthiness is a small advantage over other players. Besides, the number one focus for Security is ensuring a secure space—think of Schiphol Airport. If they decided to switch from one security solution to another, the entire operation would essentially halt, and that’s just not an option for Europe’s third-busiest airport. It’s both a blessing and a curse for the Security division: while the high switching costs make customers stick around, they also make it incredibly challenging to win over clients already using a competitor’s solution. Expanding into underpenetrated regions like the Middle East could be promising.

In Retail, however, there’s still a lot of white space. Around 33% of the market has yet to adopt an RFID solution. If Nedap can lock in these first-time customers and maintain their high retention rates, this segment could become a nice growth engine. However, because of that, competition is fierce and competitors with aggressive pricing could eat into their growth potential.

Livestock is a bit trickier. I think the moat here is tied to SmartTag-as-a-Service. The recurring revenue model is appealing because it turns what would otherwise be a one-off sale into a steady income stream. However, the switching costs for farmers aren’t as high as in Healthcare. Farmers could, in theory, switch to a competitor offering similar features if the alternative were cheaper or more effective.

Nedap’s financials definitely suggest there’s a moat. With a return on invested capital (ROIC) above 30%, the company clearly has strong profitability. However, they can’t reinvest all those profits back into the business because growth opportunities in their current markets are somewhat limited. So, instead of letting the cash pile up, they distribute it to shareholders through dividends.

When asked why Nedap doesn’t reinvest more profitably into the business, CEO Ruben Wegman responded:

"The trick is profitability. I can throw money at anything, spending it isn’t the issue! But making it profitable is the hard part—you have to be careful not to have too much idle money in the business. Every year, we assess how much we need for innovation and development, and the rest is paid out. But, mind you, we spend 18% of our revenue on R&D. We’re investing like crazy. The goal isn’t to have a high pay-out ratio; it’s simply the result of the choices we make."

In other words, they’re not holding back on investments—spending 18% of revenue on R&D is significant. The high dividend pay-out isn’t the goal in itself; it’s simply the outcome of their strategic choices.

Culture

While switching costs in software and services create a moat, there isn’t a significant barrier to entry outside of these areas. However, what truly sets Nedap apart is its corporate culture and management, which play a crucial role in driving the company's success.

Nedap fosters a highly entrepreneurial culture, where personal responsibility, independence, and employee ownership are at the core. A great example of this is their approach to time off—employees don’t need to request vacation days; they can simply take them whenever they want. That might sound like a recipe for abuse, but at Nedap, where responsibility is deeply ingrained in the culture, it works seamlessly.

A telling statistic that underscores this culture? Nedap's sick leave rate stands at just 2.9%, compared to the national average in the Netherlands of around 5%. This speaks volumes about employee motivation and engagement—because at the end of the day, it’s the employees who need to turn investments into success.

Nearly all employees are also shareholders, which reinforces this sense of ownership. However, Nedap wasn’t always like this. It was once known as an inventor’s workshop. And they were fully aware of that themselves. That’s why it was refreshing to read the following in their annual report:

”This has led us to determine that a focus on results should play a more prominent role in our culture… As a result, clear progress has been made throughout the organisation over the past year on explicitly stating expectations in terms of concrete goals. The importance of achieving goals to build and expand leading market positions is now widely supported.”

Additionally, Nedap wants its employees to share in the company’s value growth. This does come at the expense of returns for shareholders in the short term. However, in the long run, it should pay off for shareholders by fostering more engaged and loyal employees. How does it work?

Since 2010, employees can buy depositary receipts for shares (certificates) using 6.5% of Nedap’s profit before tax, which is allocated annually. In 2023, 74% of employees participated, and the program now represents 3.3% of Nedap’s share capital—showing strong employee engagement.

Launched in 2013, the Nedap Additional Participation Plan (NAPP) rewards employees for exceptional profit growth. If EBIT grows 5% above a benchmark (calculated using a 3-year average), 40% of the additional profit is distributed as certificates with a 4-year lock-up. In 2023, employees received €1.9 million under this plan, reflecting Nedap’s strong performance.

Still, I’m not a big fan of it, to be honest. I think the 5% threshold is too low—especially if inflation hovers around 3% in the coming years. However, as I’ll show later in my valuation model, the impact isn't as bad as it might seem at first.

Finances

Balance sheet

Nedap burned through a big chunk of its cash in the first half of 2024, dropping from €10 million to just €1.5 million. That might sound worrying, but looking at the numbers, they’re still in a solid spot. With an operating cash flow of €9.6 million in H1 2024 and about €6 million in CAPEX, plus their 2023 results where they pulled in ~€11.5 million in free cash flow (FCF) things are looking profitable overall. Their debt-to-equity ratio sits at around 0.3x, which is pretty healthy and shows they're not overly leveraged. With a net debt-to-EBITDA ratio of 1.34 (21,115 of net debt and 15,734 of EBITDA), their debt levels are well under control. While their cash flows took a hit, I believe their operational performance will bounce back and generate stronger cash flow in the coming years.

The real question is whether management can keep things steady. If they insist on keeping the dividend payouts at the same high levels—around €20 million in 2023 and €21 million in 2024—they might run into some trouble. Right now, with only €1.5 million in cash and lower revenues in 2024 compared to 2023 (which means less cash coming in), taking on debt just to keep dividends going wouldn’t be a smart move. If they go down that road, it’d definitely raise some red flags.

CEO Ruben Wegman addressed the topic of cutting dividends when asked whether they’d consider it if a great investment opportunity came along. Here’s what he said:

"You’ve seen our ROIC—when we invest, we do it with high returns. If we can invest responsibly and explain it well to our shareholders, they understand. But the kind of investments we make don’t require much capital (no factories, no big acquisitions). If we were to cut the dividend for some new idea, we’d need a really good explanation because we aim to be as predictable as possible for our shareholders. But in principle, it could happen."

Margins

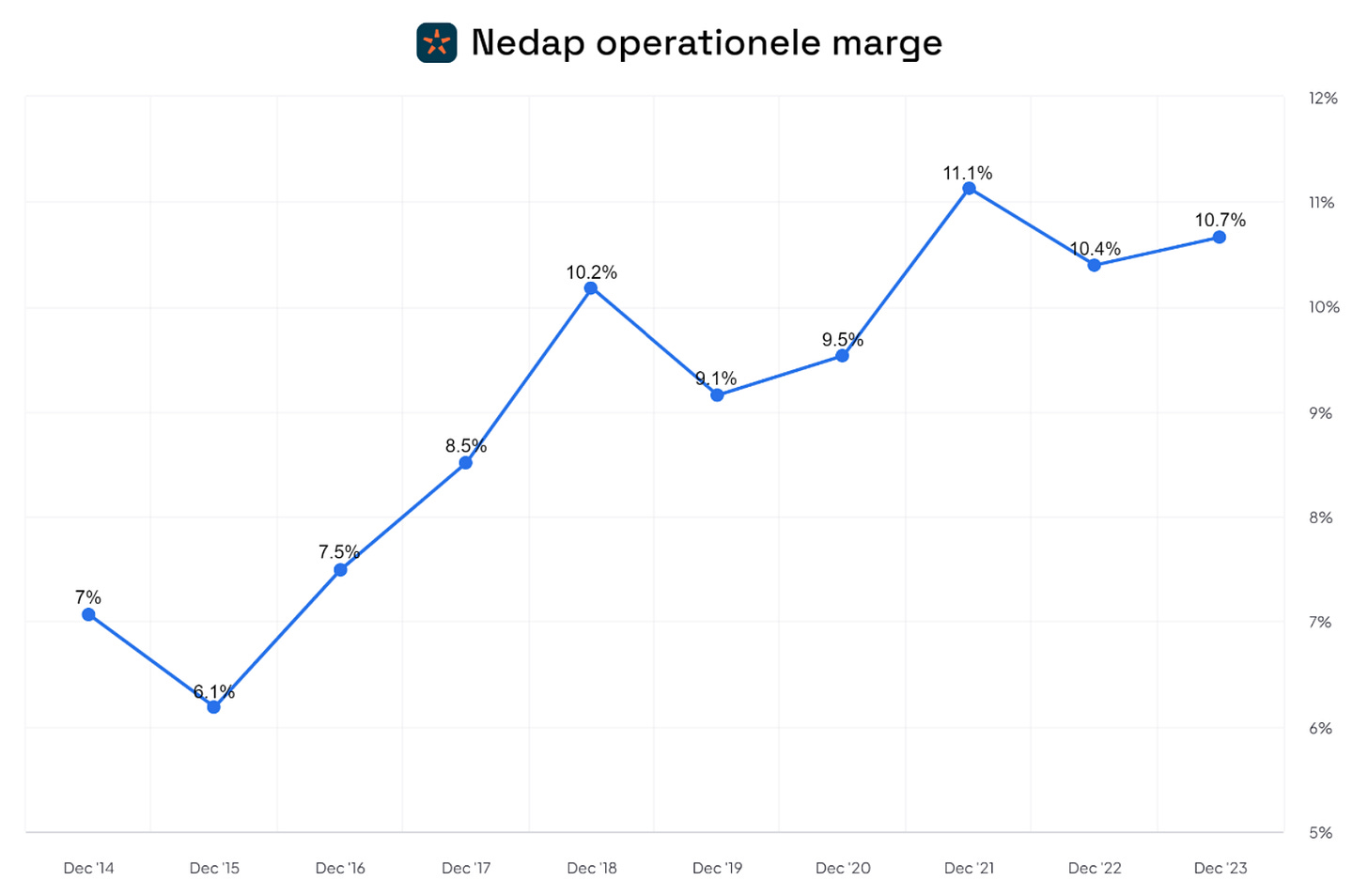

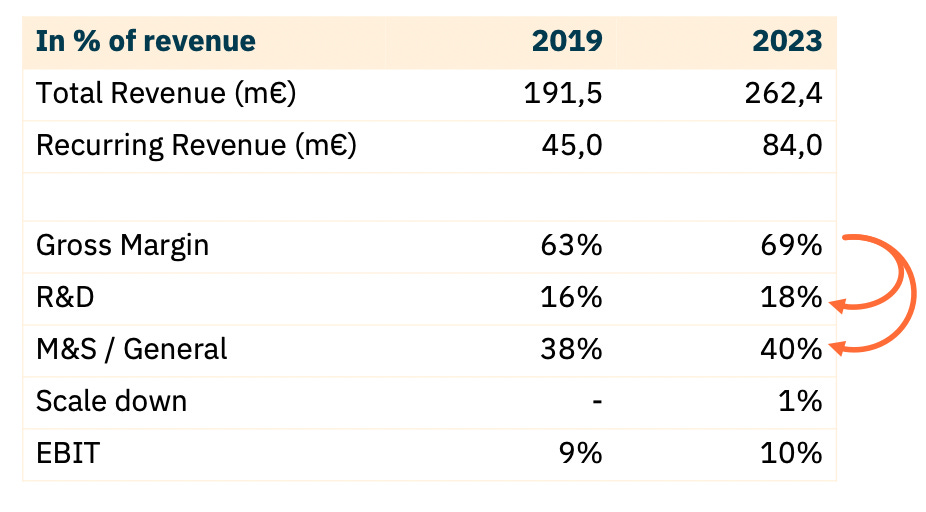

I've been talking about Nedap's transformation from a hardware company to a software-driven business, and some of you might be wondering if this shift is reflected in the numbers. Well, it is—the gross profit margin clearly showcases this transition, increasing from 63% in 2019 to 69% in 2023:

Over the years, Nedap's operating profit margin has been growing nicely, but in the past few years, it’s has stagnated. That’s mainly because they’ve been pouring a lot into R&D and hiring more people. The good news? Management has reassured investors that they’ve now got enough people on board for the next phase. The headcount grew faster than the costs, and in the next few years, they’ll need to turn that around so Nedap can really prove its scalability.

Nedap is aiming for a 15% operating profit (EBIT) margin by 2026, which is a pretty big leap. But for a company that's becoming more like a SaaS business in terms of revenue, hitting that target should definitely be within reach. Unlike industrial companies that can’t always control their costs because they rely on raw materials, or insurers who can get hit by unexpected disasters, tech companies usually have a solid grip on their expenses. Just look at Amazon, Salesforce, and Shopify—they’ve all shown how it's done.

Nedap is no different; they’ve got their costs under control because personnel expenses make up the biggest chunk of their spending. If they stopped hiring today, their profit margin would probably shoot up to 15% pretty fast. But they’re choosing not to pull that lever just yet.

As you can see in the chart below, they could hit that 15% margin tomorrow if they stopped investing in the business, but that would come at the cost of future growth. You can only increase margins once, but revenue can keep growing forever. So, if it’s a choice between growing revenue or margins, revenue should always come first.

That said, for Nedap to be a great investment, they’ll need to push those profit margins higher sooner or later.

Let’s go a step further based on what Nedap shared during their Capital Markets Day. They didn’t give us exact profitability figures per market segment, but they did provide revenue percentages for each. Since Healthcare has grown a bit and Livestock has shrunk, that’s why I estimated both at 30% of total revenue earlier in this blog.

So, why does this matter? Well, we can take a rough guess at the costs for each market segment. How? Just go to LinkedIn, check out how many employees are linked to each segment, and use that to estimate profitability per segment. Here’s what we found:

Livestock: 140 employees (20% of staff)

Healthcare: 282 employees (41% of staff)

Security: 97 employees (14% of staff)

Retail: 172 employees (25% of staff)

Now, keep in mind—these numbers are based on 691 employees who have linked themselves to a market group on LinkedIn. The real numbers might be different, so take this with a grain of salt.

What Stands Out?

Healthcare and Retail have way more employees compared to their revenue share. Especially Healthcare—its staffing numbers are huge in comparison. This could mean that Healthcare might actually be operating at a loss. At the very least, it’s pretty clear that this segment is dragging down overall profit margins. On the flip side, Livestock and Security are likely the cash cows, with strong profit margins.

Of course, this doesn’t tell the whole story. Healthcare and Retail bring in a lot of recurring revenue and less hardware sales, which might naturally require more manpower because of ongoing innovations and supporting longer term customer relationships.

But the story seems to check out when you look at this slide from Nedap:

Nedap categorizes its solutions into three phases:

Create: This is all about developing the product and testing market demand.

Scale: Time to push growth and capture market share—lots of revenue growth, but profitability lags behind.

Core: The "cash cow" phase—market dominance is achieved, growth slows, but profitability skyrockets.

Security has two products in the 'core' phase, meaning they should generate solid profits. The employee numbers back this up. On the other hand, Healthcare is still in the 'scale' phase with their Nedap ONS healthcare system, which explains the heavy costs and lower profitability.

Why This Is Actually Good News

To me, this confirms that Nedap’s long-term profit margins should increase relatively easily. Their ONS healthcare system plays a key role here. We know a few things for sure:

ONS accounts for nearly 100% of Nedap Healthcare’s revenue.

Healthcare currently makes up about 30% of Nedap’s total revenue.

This 30% is likely running at 0% margins or worse.

At first glance, you might think that unprofitable revenue isn’t valuable for shareholders—but this could actually be a huge opportunity. There’s no better revenue than 100% recurring revenue, and the beauty of it is that customers rarely leave at Healthcare (99% retention rates). Plus, their clients are healthcare organizations, which means zero bankruptcy risk.

If ONS gradually moves from 'scale' to 'core' over the next five years, the impact will be massive. They won’t need 130 developers anymore, and the sales team can shrink significantly, since they’ve already captured 60% market share in elderly care and 50% in disability care and domestic help. If this market share increases in these winner-takes-all markets, then the sales team isn’t that much of a necessity anymore.

Right now, ONS is weighing down the profit margins, but in the next few years, this will start to shift as revenue grows faster than hiring. In 5 to 10 years, ONS could actually boost Nedap’s overall margins.

Similar software companies achieve profit margins of 30-40%. Even if Nedap only gets part of the way there, the impact on their overall profitability will be huge. So, while the numbers might look rough now, the long-term picture is looking pretty exciting.

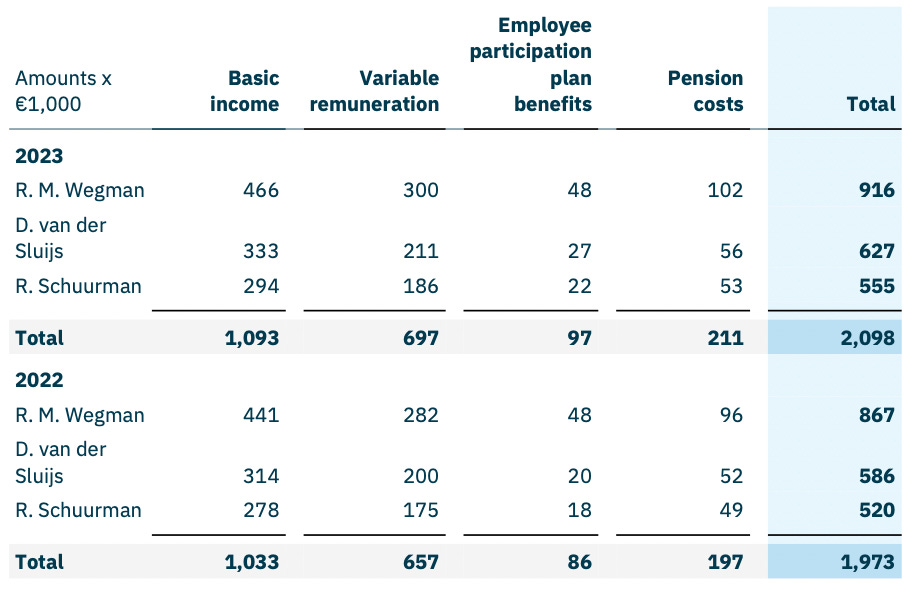

3. Is it managed by a capable and shareholder-aligned team?

Nedap’s management is a three-person team, but the CFO left at the start of 2025. Now, this is purely my speculation, but it’s interesting timing because a new major shareholder, Steflot (the family fund of Rolly van Rappard, founder and CEO of private equity firm CVC Capital), has just come on board. Maybe the Nedap board, while hunting for a new CFO, had a few coffees with this influential shareholder and tapped into their network. Who knows, they might already have someone lined up to help take Nedap to the next level. Just a guess, but I’m curious to see who steps into the role.

The star of the show, though, is CEO Ruben Wegman. He’s been running the ship since 2009, making him one of the longest-serving CEO’s of any company on the Dutch stock exchange. And before that, he was already part of the executive team for seven years. He’s been there from the start of Nedap’s massive transition from hardware to software, and hopefully, he’s sticking around a bit longer to see it all play out.

A few great quotes from an interview with Wegman:

"Nedap feels like a perfect fit, but the real question is: 'How long do you stay?' It's not about me, it's about the company. It's about making sure the next generation can take over smoothly. Sometimes, that means holding myself back—like when there's a meeting with a customer about a new proposition. In those cases, I let someone else handle it, and I’ll hear how it went later. Usually, I end up being the one calling, because waiting for them to call me back is tough for me."

"In the end, you get the shareholders you deserve, and they know that whenever they call me, I'll always pick up the phone."

"The majority of my wealth is in Nedap shares. I am required to invest 50% of my bonus into Nedap shares, but I always put in 100% and never sell."

This really shows how passionate he is about the company—Nedap feels like his kid. He gives off major founder vibes, and honestly, Nedap’s transformation is his doing, making it feel just like a founder’s journey.

Wegman holds nearly €3 million worth of Nedap shares, which is about six times his base salary. That’s fine. Having skin in the game is always reassuring, but honestly, when you hear Wegman speak, it doesn’t come across like he’s in it for the money—which I appreciate even more. As far as I know, management hasn’t bought any additional shares in the past few months.

Management's salary isn’t excessive. When it comes to their incentives, they are evaluated based on the following KPIs:

Revenue

Operating margin

Recurring revenue

Operational cash flow per quarter

4. Is it fairly valued?

I try not to overcomplicate things when it comes to valuation. I like to stick to Marks’ advice: “Good investing doesn't come from buying good things, but from buying things well.” That said, I also believe that when investing for the long term in what you consider quality companies, it’s better to be right about the company itself rather than getting the valuation exactly right. In my portfolio, I also hold some lower-quality names, and for those, I prefer a lower entry price to compensate for the risk. However, I think Nedap is a solid company, so a fair price is good enough for me.

For my valuation, I use a scenario analysis, where I make a conservative estimate of three key factors:

Revenue growth

Net profit margin

Exit multiple

Let’s start with revenue growth. Nedap’s 2024 results will be out next month, and my estimate is that their revenue declined by a few percent. This is due to the tough comparison with 2023, when revenue saw a big jump driven by pent-up demand after earlier supply chain disruptions. That’s why I’ve projected a -3% decline in year 1.

After that, I expect revenue to grow at 8% per year. Nedap itself projects high single-digit organic revenue growth for the 2025-2028 period, which is consistent with their performance in recent years. Given their leading solutions in markets that are neither too fast- nor too slow-growing, I think this estimate is reasonable.

On top of that, Nedap’s recurring revenue has been growing at a 17% CAGR over the past five years and now accounts for 40% of total revenue. Nedap is currently in a similar phase to what companies like Adobe, Autodesk, and Oracle went through during their transitions to subscription-based models, which temporarily impacted revenue growth.

The fact that Nedap has still managed to achieve an 8% CAGR despite these challenges makes me quite optimistic that they can achieve similar growth over the next five years. And with the potential for even more upside once their transition is complete and recurring revenue continues to perform as it has.

Next up is the net profit margin, and I’m using 12% in my estimate. Nedap has set a target of a 15% operating profit margin by 2026, which translates to around 12% net profit margin. In my projections, I expect Nedap to reach this 12% margin by 2028. I'm fairly confident in this estimate based on the reasons I outlined earlier in the blog regarding Nedap’s current margins and their potential growth as they transition into a SaaS-driven company.

Regarding the NAPP (Nedap Additional Participation Plan), Nedap’s annual report states: "Costs for which a purchase discount and bonus depositary receipts are recognized under other personnel costs, while other costs are recognized as wages and salaries." Since the NAPP costs are explicitly categorized under "wages and salaries" and "other personnel costs," it’s clear that these expenses are already included in the reported personnel costs, and therefore, in the EBIT. This means that, even though I might not fully agree with the low threshold for participation, these costs are already factored into Nedap’s operating margin target and, consequently, into my valuation model. So, even with these costs included, there’s still potential for a solid return on Nedap.

Thirdly, the exit multiple. This one is tricky because, since I’m not using a DCF, a lot of assumptions are packed into this single number. That’s why I try to be as conservative as possible without going to extremes. I’ve chosen 16 as a conservative estimate. Currently, Nedap is trading at around 20 times earnings. By the time of exit, their end markets might be more saturated, but given the improving quality of their revenue streams (more stability, predictability, and scalability), I believe a higher multiple than 16 could also be justified. So, settling at 16 feels like a conservative, yet reasonable and balanced approach to me.

If I put these three estimates together, I come up with a potential return of around 10%, not including dividends, which are currently about 5%. That would bring the total to roughly 15%. Just to be clear—these returns aren’t set in stone, and everything here is based on my own estimates and assumptions. So, don't take it as a sure thing! This model is based on Nedap’s stock price of €58.60 as of Monday, January 20th.

Finally, let’s take a look at a similar software company in the Netherlands—Wolters Kluwer, which operates in the software industry as well. Wolters Kluwer and Nedap are comparable in the sense that they both generate recurring revenue: 83% of Wolters Kluwer’s revenue comes from recurring sources, compared to 40% for Nedap.

Wolters Kluwer is widely recognized as a strong recurring revenue player, and the market rewards them with a high P/S ratio. And that makes sense—Wolters Kluwer's net profit margins have been consistently rising for years, while for Nedap, it's primarily their gross profit margins that have shown improvement so far.

However, despite Nedap’s ongoing transformation into more of a SaaS company, their P/S ratio remains the same. As we’ve discussed throughout this blog, Nedap is clearly evolving into a different kind of company. Plus, when it comes to growth, Nedap's recurring revenue is increasing much faster—17% CAGR since 2019 (and even accelerating to 20% in Q3 2024) , compared to Wolters Kluwer’s 6%.

Sure, Wolters Kluwer might be overvalued and of course all the details should be considered, but let’s put things into perspective. Nedap’s recurring revenue of €100 million should be worth at least 4x its revenue, right? That alone would already exceed Nedap’s current market cap of around €380 million. This makes me think Nedap might be undervalued, especially with their fast growing recurring revenue and the shift to a more stable, high-margin business model.

5. What are the risks?

Finally, it’s important to briefly review the risks associated with an investment in Nedap, as these can impact the company’s future performance and growth:

Unsuccessful Proposition and Product Development: Nedap’s ability to innovate and bring successful propositions and products to market is crucial. A failure in this area could severely impact its competitive position and growth potential. Of course, at the moment they have quality solutions and with the switching costs playing out - innovation is less important than with new hardware I believe. However, it’s still a risk of course.

Departure of CEO Ruben Wegman: Wegman has been a phenomenal leader, driving the company with a sharp focus on the right priorities and fostering a strong organizational culture. His departure could create uncertainty and disrupt the company’s trajectory.

AI Opportunities and Risks: While AI brings a lot of exciting market opportunities, it also comes with its own set of risks. To tackle these challenges, Nedap has set up an AI task force to stay ahead of the game and make the most of AI. That said, I feel like AI will be less of a threat when it comes to niche vertical market software.

Market Disruption: Nedap operates across multiple market segments, which diversifies its revenue streams but can reduce focus. This lack of concentration in any single market could make individual market groups more vulnerable to disruption by competitors. Not all of these market groups have a strong competitive moat to protect them.

Talent Shortage: Like many companies in the Netherlands, Nedap struggles with attracting and keeping qualified talent. Since their HQ is in Groenlo—pretty far from major cities like Amsterdam and Rotterdam—hiring can be a challenge. That said, Nedap has managed to bring in a lot of new people over the past few years, and for now, their workforce seems solid enough to support growth in the coming years. So, it doesn’t really feel like the biggest risk at the moment.

I think Howard Marks has a lot of insightful things to say, and one of my favorite quotes on risk is:

"There’s a big difference between probability and outcome. Probable things fail to happen—and improbable things happen—all the time. That’s one of the most important things you can know about investment risk.”

I think that’s a great note to end this analysis on.

Final words

So, why is this opportunity here? Maybe the market hasn’t fully caught on to Nedap’s higher-quality SaaS revenue yet? Or it could be the selling pressure from big shareholder Van Lanschot Kempen, who’s been offloading shares in 2024, keeping the stock price from moving?

The great Canadian small-cap investor, Jason Donville from Donville Kent Capital, recently said in a podcast:

"Let’s say a company comes to my attention that I haven’t looked at before. One of the first things I look at is the 10-year share price chart. If this business is as it appears to me right now, it should be reflected in a chart that shows the company performing well over time. And if that company has been going sideways, then the first question I have to ask myself is: did something change? Are they improving? Is there something new going on here? What explains why this stock hasn’t gone anywhere? Sometimes, it’s good year, bad year, good year, bad year. But sometimes, in the SaaS space, it's a company transitioning from the old system of purchasing software to subscription models. They often go through an 18-month period where their numbers might make it look like they’re not doing too well, but it’s just the conversion. If you can get in late in that conversion, you can do really, really well."

Either way, I’m excited to see where things go from here.

Alright, I’ve talked enough. To the ones still reading—thank you! Hopefully you found this useful. I certainly did.

Luuk

-

Disclaimer: This analysis is not intended as investment advice but as a personal opinion and can serve as a supplement to your own research. The information is explicitly not intended as advice to buy or sell certain securities or securities products, but to provide an overview of the underlying company/companies. You are solely responsible for the decisions you make regarding your investments.

What an awesome analysis! Great job. I am here for those kind of articles (no the usual click bait) thanks a lot

👍👍