A Deep Dive into Interactive Brokers (IBKR)

Unveiling the Brokerage Powerhouse: My Investment Analysis of Interactive Brokers (IBKR)

My investment philosophy is focussed on buying high-quality businesses that can grow their intrinsic value at high rates over a long-time horizon. To be honest, that sounds easier than it really is. What is high-quality for me? It involves a sustainable competitive advantage, lots of growth potential, a solid balance sheet, great returns on capital and talented, trustworthy managers.

I came across Interactive Brokers (IBKR) after an investor who focuses on quality investing as well, Rob Vinall, opened a position at the start of 2023. Together with frustrations of my own broker, DeGiro, I started looking into whether I could switch or maybe even invest. I’m a big fan of investors who are transparant, which is why I’ll disclose that I did both. IBKR is one of my ten positions, and makes up ~9% of my portfolio as of June 2024.

In this blog, I’ll delve into the business and why I think it is high-quality. In order to keep it clear and structured, I’ll answer the following five questions:

What does Interactive Brokers do?

Is this a high-quality business?

Is it run by a competent management team?

Is it available at a reasonable valuation?

What are the risks?

1. What does Interactive Brokers do?

IBKR is an online brokerage that offers a lot of financial instruments such as stocks, bonds, options, futures, mutual funds, precious metals, foreign exchange and even cryptocurrencies through third-parties. In essence, IBKR helps anyone buy and sell multiple different assets through their platform. With 2.8 million accounts worldwide, IBKR provides access to over 150 markets and serves customers in more than 200 countries. The platform is known for its low prices, broad market access, and advanced trading tools.

In short, IBKR earns money in two ways: commissions and interest. Historically, the revenue mix has been 50/50, but with interest rates rising it is now closer to 40/60.

1) Commissions

IBKR earns money through commissions with two different products: IBKR Pro and IBKR Lite.

IBKR Pro uses the traditional brokerage model, charging commissions on trades. Conversely, IBKR Lite was introduced in 2019 in response to the trend of commission-free trading. It operates on a zero-commission basis, earning revenue through payment for order flow (PFOF). With PFOF the broker, like Robinhood or IBKR, receives compensation for routing the orders they receive to market makers (like Flow Traders). Without diving too deep in the whole world of market makers, PFOF does result in customers paying higher prices for their desired assets. Retails investors won’t have orders of sizes that it really matters, but institutional investors do. That’s one of the reasons why Robinhood, which only earns money because of PFOF, is not the preferred broker for these wealthier customers.

Despite the availability of the Lite plan, close to 94% of customers prefer the IBKR Pro plan after evaluating both options. IBKR earns a similar amount from customers regardless of the plan they choose. IBKR only introduced the Lite plan to show the industry it’s not hard for them to offer a zero-commission trading platform, comparable to those of Robinhood and Schwab.

2) Interest

The second stream of income for IBKR is money earned on interest. Here’s how IBKR does it:

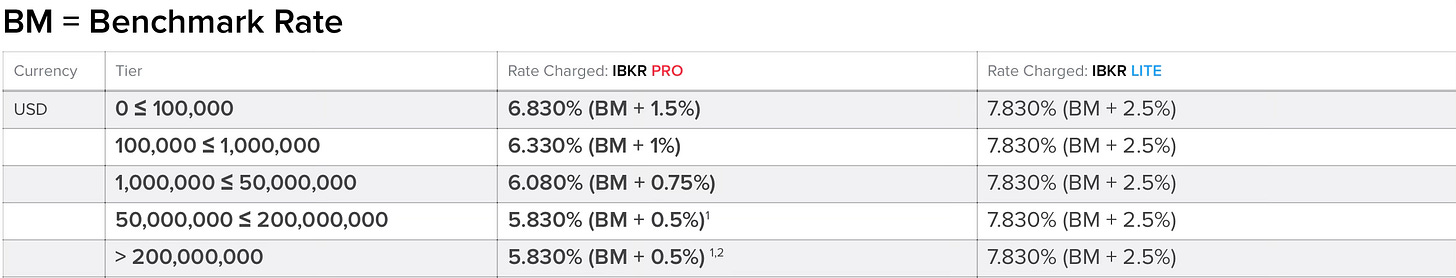

Margin Lending: When customers want to borrow money to buy more stocks, IBKR lends it to them. This is called margin trading. The company makes a lot of money from the difference between what they charge for these loans and what they pay on customer cash balances. For their Pro customers, the interest rate spread varies from 0.5% to 1.5%, depending on how much is borrowed. The great thing about IBKR is their transparency with customers. They add a standard percentage on top of the benchmark rate (Federal Funds Rate), making their calculations and intentions clear and pure. Since IBKR doesn’t borrow money themselves at the parent company level, they get to keep all the profit from this interest spread.

Customer Cash Balances: IBKR also earns interest from the cash that customers leave in their accounts. They keep all the interest on balances under $10,000. For balances over $10,000, they pay the account holders the benchmark rate minus 0.5%. For Lite account holders, IBKR keeps an even bigger share of the interest. This setup helps IBKR earn a lot more, especially when interest rates go up.

Securities Lending: Sometimes, IBKR lends out securities to other investors and earns interest based on how much those securities are in demand. This only makes up about 4% of their interest earnings though.

The IBKR Pro and Lite plan do differ like on the commissions side of the business. IBKR ensures a higher net interest margin on Lite customers by charging 100 basis points more on margin loans and offering 100 basis points less interest on cash balances compared to the Pro plan.

In 2023, most of IBKR’s interest income (about 92.5%) came from margin loans, interest on cash and securities, and other interest-earning assets. Their net interest margin (the difference between what they earn and what they pay) jumped from 1.53% in 2022 to 2.36% in 2023 because the average federal funds rate increased from 1.68% to 5.03%. It’s fair to say that IBKR is very much a beneficiary of interest rates staying higher.

Who are IBKR’s customers?

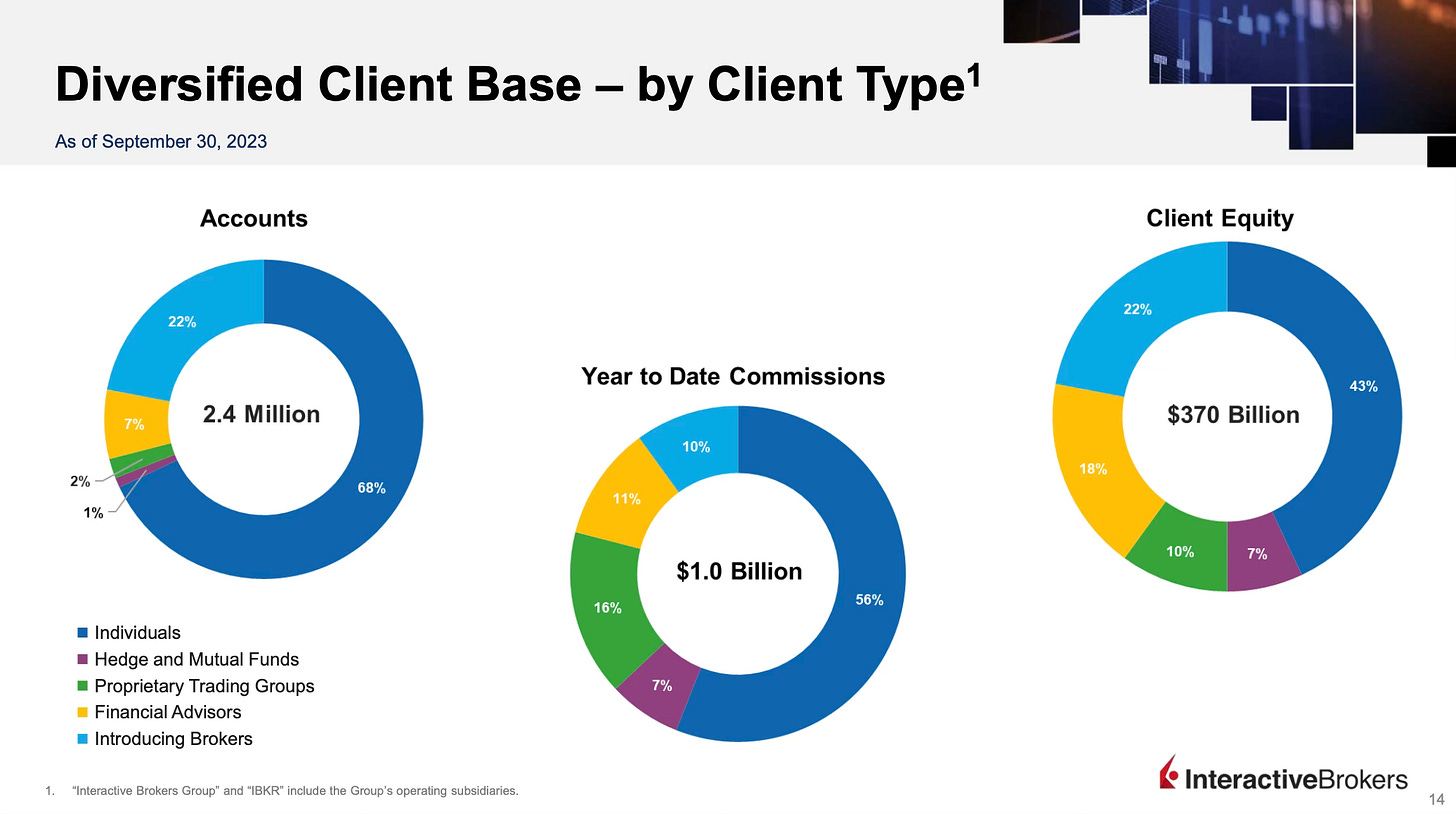

The following two pictures give a good overview of IBKR’s client base by geography and client type.

Some of the things I noticed are:

IBKR has a rich American client base, earning 52% of commissions and having 47% of client equity, while only making up 31% of customers.

Great diversification across geographies where I expected lots of customers from the US, it’s Asia-Pacific taking the #1 spot. IBKR is really executing globally.

I expect a lot of growth in commissions and client equity will come from the Asia-Pacific region with a lot of customers already there, and them only getting richer. This is already visible with 80% of new customers coming from outside the US.

Some of the things I noticed are:

Retail investors (individuals) make up 68% of their customer base, 56% of commissions and 43% of client equity. It is their most important group.

But, comparing individuals with hedge and mutual funds, trading groups and financial advisors; individuals aren’t as important as it first seems with them making up 68% of customers. Why is that? Individuals make up 68% of the client base, but only 43% of client equity. The most profitable customers are these bigger fish. Hedge funds make up 1% of customers, 7% of commissions and 7% of equity. One customers (fund) can have tens of millions in equity and will execute (way) bigger trades. Trading groups are 2% of customers but 16% of commissions! Next to that, these business-to-business customers are very sticky.

The second largest group based on accounts and client equity are ‘introducing brokers’.

What are introducing brokers?

IBKR white-labels its platform for use by other brokers as a backend. These third-party brokers, known as ‘introducing brokers,’ manage their own marketing and customer service while utilizing IBKR's backend for trading and clearing operations. Introducing brokers generate revenue similarly to other IBKR account types, paying standard commission rates and interest on cash and margin loans before marking them up for their end customers.

Let me explain it more clearly using the Dutch introducing broker Lynx as an example. Lynx uses the entire IBKR platform, acting as the interface that customers interact with. They handle customer service and provide information in Dutch, making it more accessible, but a significant portion of the revenue still goes to IBKR. Lynx can advertise global trading capabilities, while IBKR manages all the backend operations. IBKR has developed all their IT infrastructure (building 90% of their own software). IBKR can operate globally, and they don’t handle sales directly—Lynx does the legwork for them in the Netherlands. IBKR benefits from more customers through Lynx. Other examples of introducing brokers include Tiger Brokers and Futu Holdings, two leading brokers based in Asia.

So, that’s a basic summary of the business. In the following pages, I’ll show how and why I believe IBKR fits my definition of quality—they have a competitive advantage and growth.

2. Is this a high-quality business?

The second question I’m going to tackle is quite broad, especially since 'high-quality' can mean different things to different people. I have some specific criteria for what makes a company high-quality, as I mentioned at the beginning of the article. Regarding the balance sheet, it's straightforward: IBKR has $10.4 billion in excess regulatory capital, which is $10.4 billion more than required by regulators. It's safe to say they meet at least one of my criteria. Management itself deserves its own discussion, so I’ll focus on the competitive advantage that IBKR has in the highly competitive brokerage industry.

Competitive Advantages

Initially, I wasn't sure what to expect. How could a broker have a competitive advantage when they all just provide access to trade stocks for a few dollars? However, upon closer examination, I believe IBKR has a substantial moat. They outclass their peers because of the following advantages:

Low-cost producer

Scale economies shared

Superior product offering

Focus on the right customers

Profitable platform

Customer stickiness

1) Low-cost producer

IBKR has the lowest costs in the brokerage industry due to their extensive automation. Since their inception, IBKR’s focus has been on leveraging technology to automate as much as possible, which drives down costs. This focus on technology is reflected in their workforce which mainly consists of people with IT backgrounds. It can also be seen in their annual report, where they state, “Our core software technology is developed internally, and we do not generally rely on outside vendors for software development or maintenance."

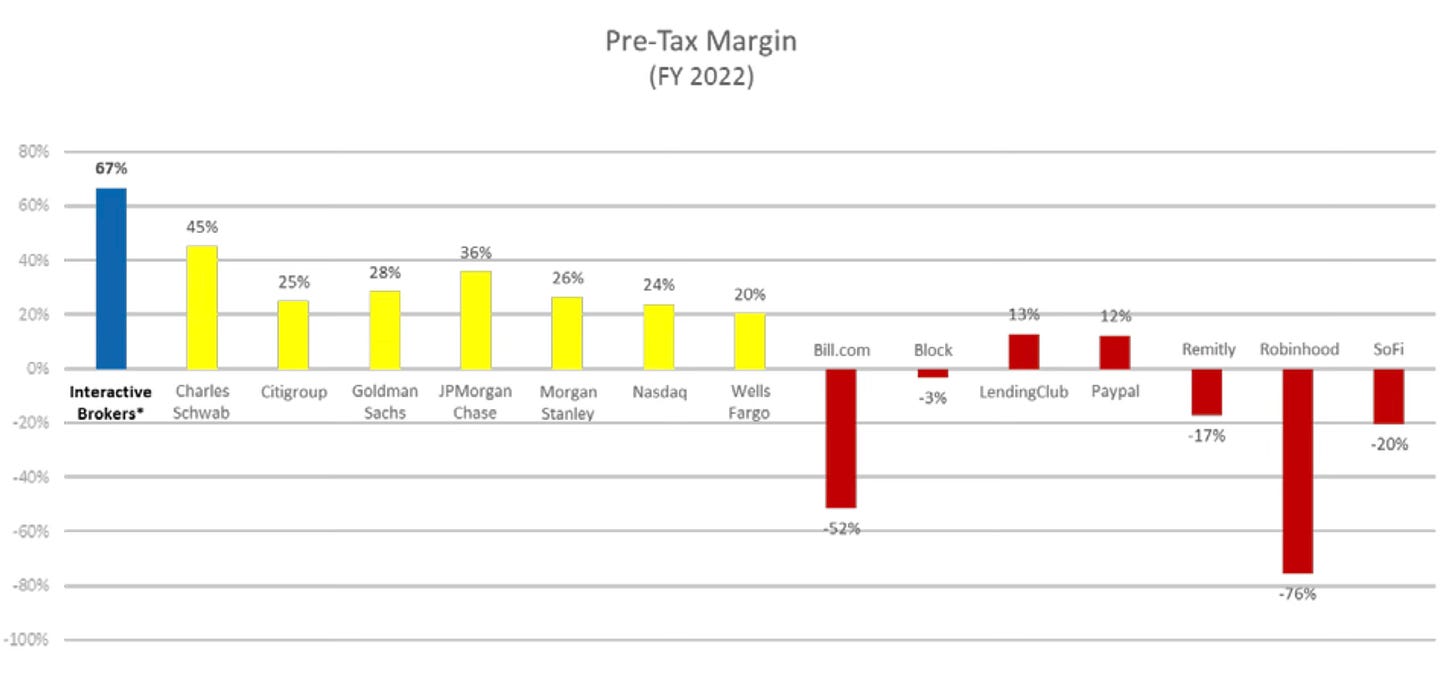

Their emphasis on technology, combined with their growing scale, has led to a best-in-class cost structure with a 71% (!) operating margin. Founder Peterffy mentioned they are content with pre-tax margins higher than 60%, so the 71% margin isn't necessarily what investors should always expect. However, a 60% margin is still insanely high and impressive (for comparison, Microsoft has a pre-tax margin of about 45%). As a result, they can offer customers the lowest trading fees, the lowest interest rates on margin loans, and the highest interest rates on deposits, all while maintaining an exceptionally high operating margin.

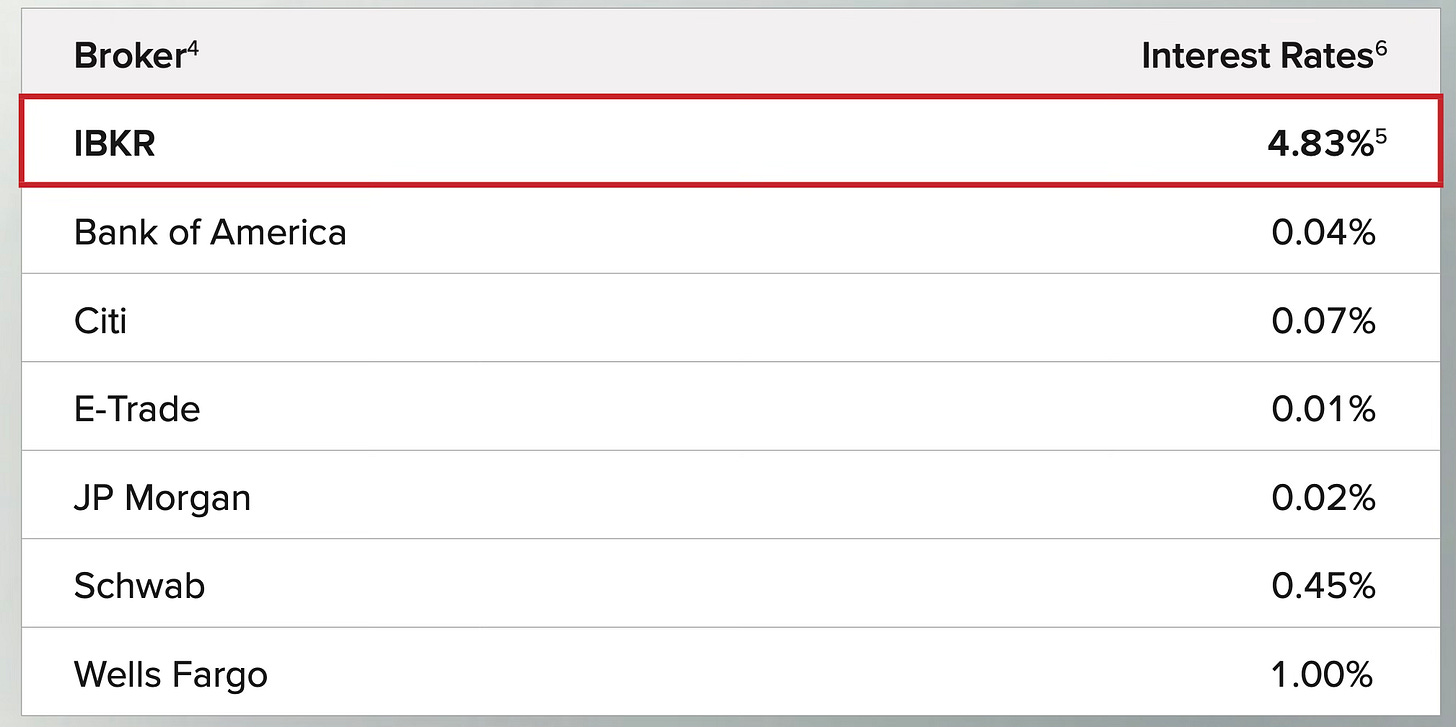

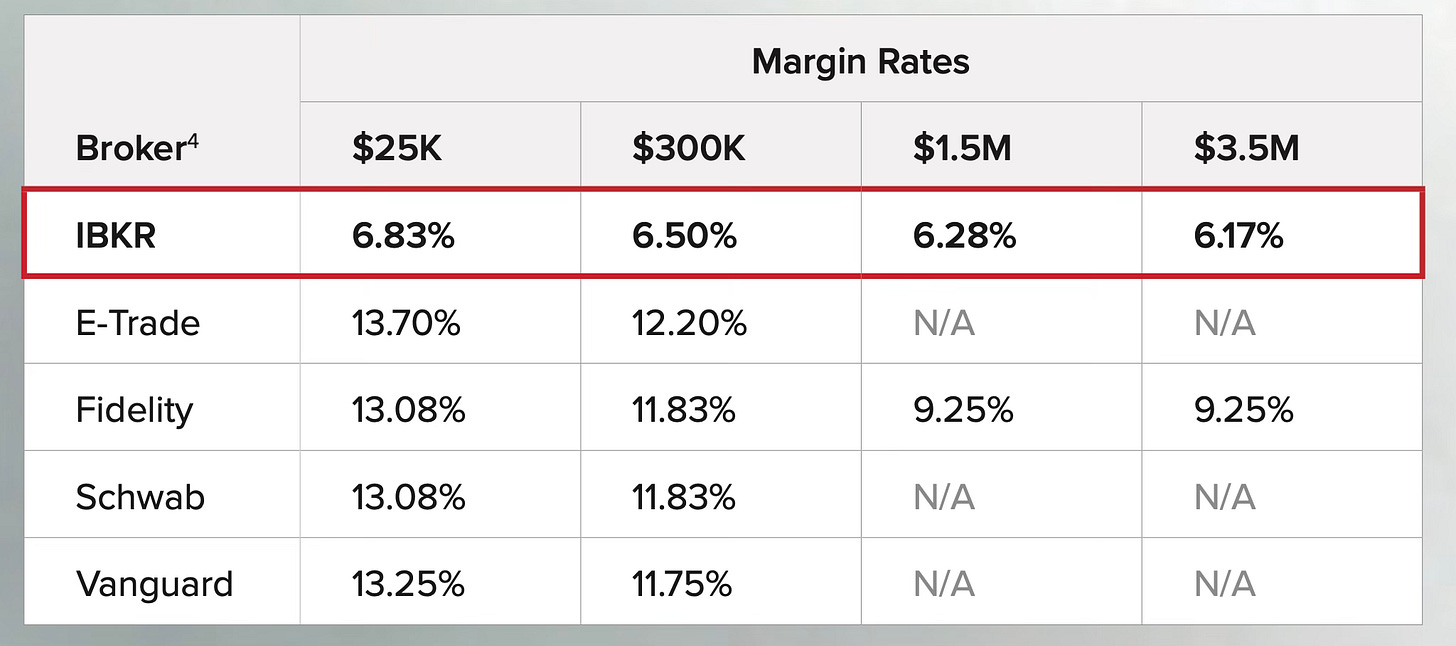

Highest interest rates of the industry (by far)

Lowest interest rates on margin loans (by far)

To illustrate IBKR's efficiency, let's compare their revenue per employee with their biggest competitor, Schwab. IBKR generates $1.45 million in revenue per employee, while Schwab generates $570,000. This means IBKR is about 2.5 times more efficient. The IBKR platform is designed to be hyper-efficient, and achieving this level of efficiency is very difficult for competitors. IBKR follows the philosophy of "automation, unless." If Schwab wants to catch up, they would need to build a system from scratch, which is nearly impossible to match in terms of IBKR's efficiency. IBKR develops everything in-house (proprietary), making their systems much more advanced.

Given that IBKR offers the lowest costs, highest interest rates on deposits, and lowest interest rates on margin loans, it’s remarkable they are achieving all of that while having an operating margin exceeding 60%. The efficiency and profitability are the first signs of IBKR being a high-quality company to me.

2) Scale economies shared

I've included "scale economies shared" right after mentioning IBKR as a low-cost producer because they embody this concept in their growth strategy. The company keeps investing in technology to boost automation and cut costs, and they pass these savings to their customers. Whether it's lower account fees or better interest rates on cash and margin loans, IBKR's wants to create value for the customer. While many brokers now offer commission-free trading and rely on other ways to make money like PFOF and margin rates, IBKR maintains its edge with margin rates that are less than half of its competitors (as we've seen in the picture above).

This focus on cutting costs and improving trade execution (basically, giving you a cheaper but better product) will attract more customers, helping IBKR grow even bigger. As they grow, they can invest more in their platform, creating even more value. This cycle just keeps going, and it's a strong advantage. All the while, IBKR still has impressive margins of way above 60%.

3) Superior product offering

When it comes down to product offering, IBKR really stands out among their peers. They serve customers from over 200 countries and offer trading on more than 150 electronic exchanges. Compare that to competitors like Schwab and Fidelity, who only give you access to a fraction of those exchanges, with just 30 and 25 foreign markets respectively. And Robinhood? They don’t even let you trade stocks on foreign exchanges! IBKR covers a whopping 27 different currencies, way more than anyone else, with their biggest competitor, Schwab, only offering access to only 7. That’s a big deal and shows how strong IBKR is in the market.

You can trade everything from bonds to futures, foreign exchange, and derivatives with IBKR. They're your one-stop shop for all your investing needs, especially if you're into global trading. And they don't stop there. IBKR offers some seriously advanced trading tools that go beyond what other brokers offer. They have all sorts of fancy order types, extended trading hours, and algorithms to help you make better trades.

What really makes IBKR stand out is their trade execution. They use a special dual-auction system that ensures you get the best deal possible by working with 16 market makers and exchanges. This is different from other brokers who rely on PFOF, which can result in customers paying higher prices for their desired assets. IBKR is aligned with their customers’ interests, which is rare for a broker—actually, I think they might be the only ones who do this.

Lastly, IBKR offers platform APIs, making it easy for you to integrate your own software and algorithms, giving you even more flexibility and power as a trader. This isn’t a big deal for the ordinary retail investors, but it is the reason that 16% of commissions are earned through trading groups.

4) Focus on the right customers

We finally arrived at the question whether IBKR is focussing on the ‘right’ customers? Who are the ‘right’ customers though? The 'right' customers for IBKR are those who perform the biggest trades, such as hedge funds, mutual funds, and financial advisors, as well as those who trade frequently, like trading groups. IBKR's strategy revolves around providing these investors with the best tools, the lowest costs in the industry, and great transparency. Here are some key points:

Best Tools: The IBKR platform is made for institutional investors like hedge and mutual funds, but they made it available for retail investors too.

Lowest Costs: IBKR offers the industry's lowest costs. This is a big deal for customers trading with lots of money. And I think it matters as well ;)

Interest on Deposits: They only pay interest on deposits above $10,000. It shows that they do not really care about the smaller fish, like all the individuals starting because they had nothing better to do in the pandemic. They focus on the wealthier ones.

Transparent Costs: Customers pay just 0.5% more than the benchmark rate, no matter what that benchmark is. They are transparant towards customers and don’t have hidden costs.

No Securities Lending: They don’t lend out your securities unless you explicitly choose to. If you agree to it, you even profit from it since they share the earnings with you. It’s almost too fair.

No PFOF for Pro Accounts: IBKR does not engage in PFOF for Pro accounts. Robinhood and DeGiro’s only way to make money is through PFOF.

This focus reminds me of GEICO’s approach: Don’t just grow for growth's sake; care about who your customer is. If we take a closer look at their competitors, it becomes clear that some of them lack that focus.

Let's examine some industry stats:

Fidelity: ~44 million customers

Charles Schwab: ~35 million customers

Robinhood: ~24 million customers

E-Trade (Morgan Stanley): ~5 million customers

DeGiro (Europe): ~3 million customers

Interactive Brokers: 2.8 million customers

IBKR is a small player in terms of customer numbers. However, like GEICO, IBKR isn't focused on gaining the most customers as quickly as possible. They prioritize profitable growth and target the most lucrative customers—primarily institutional investors, who make up about 59% of IBKR’s equity. In contrast, DeGiro and Robinhood have almost none.

Looking at Assets Under Management (AUM) gives an even clearer picture:

Fidelity: ~$4,500 billion

Charles Schwab: ~$7,500 billion

Robinhood: ~$80 billion

E-Trade: ~$360 billion

DeGiro: ~$43 billion

Interactive Brokers: ~$380 billion (!)

Notice something? Robinhood has nine times more customers than IBKR but over four times less in AUM. This reflects in their revenue too: Robinhood has $1.8 billion in revenue compared to IBKR’s $4.2 billion. It’s not about the number of customers; it’s about having the right ones. IBKR has high-value customers who perform more transactions, take out higher margin loans, and generate significantly more revenue per customer than their peers.

5) Profitable platform

Before diving into the brokerage industry, especially IBKR, I didn't realize that many brokers don't actually make money from their main service: enabling customers to buy and sell assets. That actually shocked me and only made my conviction for IBKR grow. Let's compare IBKR with two of its competitors, Robinhood and Schwab, to see the difference.

Robinhood’s platform revenue: Robinhood is a tricky case because it's not profitable overall, even with interest income. If we focus on their "Transaction-based revenues," they earned $1,402 million in 2021, $814 million in 2022, and $785 million in 2023. Meanwhile, their "total operating expenses" were $3,456 million in 2021, $2,369 million in 2022, and $2,401 million in 2023. So, they're far from making a profit from transactions alone.

Schwab’s platform revenue: Schwab is profitable overall, thanks to interest income, but not when you look just at their trading revenue. In 2021, their "Trading revenue" was $4,152 million, in 2022 it was $3,673 million, and in 2023 it was $3,230 million. Their "total expenses excluding interest" were $10,807 million in 2021, $11,374 million in 2022, and $12,459 million in 2023. So, they aren't profitable from trading revenue alone. They rely heavily on earning interest.

IBKR’s platform revenue: In contrast, IBKR makes money directly from their trading platform. Their revenue from commissions was $1,350 million in 2021, $1,322 million in 2022, and $1,360 million in 2023. Their "total non-interest expenses" were $927 million in 2021, $1,069 million in 2022, and $1,271 million in 2023. This means IBKR is consistently profitable from its platform alone.

This difference is significant. For example, Schwab had to invest in long-term bonds to chase yields because they aren't profitable from their trading platform. This strategy backfired when interest rates rose, as they couldn't convert their low-yielding bonds to higher yield without taking a loss. As a result, they couldn't raise interest rates on deposits or lower interest on margin loans, unlike IBKR, which had short-term bonds (26 days maturity) and could adjust to rising rates. Schwab can't afford to pay high interest on savings without risking bankruptcy, while IBKR is advertising its ability to offer the best interest rates of the industry.

IBKR's profitable platform sets it apart. While Schwab and Robinhood see declining trading revenues and would operate at a loss without interest income, IBKR can thrive on its trading platform alone. This gives IBKR a higher net interest margin, allowing them to attract more customers by paying interest and lowering margin loan rates. From April 2023 to April 2024, Schwab's customer accounts grew by 3%, while IBKR's grew by 26%. This competitive advantage for IBKR is likely to increase over time.

6) Customer Stickiness

Finally, customers in the brokerage industry tend to be pretty loyal, and this isn't unique to IBKR (which is why it's my final advantage). Think about your own experience. I found it quite challenging to switch from DeGiro to IBKR, even though I knew IBKR was the better platform. You have to pay transaction costs to sell your stocks on the old platform and buy them on the new one, or pay fees to your old broker to transfer your holdings. Either way, it costs money. Plus, it takes time and effort. While I’m really into optimizing costs and understanding the industry, many people aren’t. Most will stick with the first broker or bank they chose, even if there are better options out there. This loyalty is clear even after crises, like the collapse of SVB, where IBKR didn’t see a big jump in customer numbers.

Growth potential

After looking at all the competitive advantages IBKR has, let’s talk about their growth potential. IBKR has already seen impressive growth in the number of accounts, going from ~200.000 in 2012 to 2.8 million in 2024. And it looks like they’re not stopping anytime soon. After my comparison with GEICO, some might wonder if IBKR is trying to limit its growth compared to its peers. Are competitors growing faster than they are? Well, in 2023 the following account growth numbers were achieved:

Fidelity: +3%

Charles Schwab: +3%

Robinhood: +2%

E-Trade: N/A

DeGiro: +12.6%

Interactive Brokers: up 22% (!)

So, no, IBKR definitely wants to attract as many customers as possible. They’re just smart about it. They focus on getting the right customers, rolling out new features for traders, keeping their balance sheet strong to earn the trust of hedge and mutual funds, and ensuring their backend is solid for introducing brokers to keep growing. They have $14 billion in equity on their balance sheet with almost no debt, which is nearly $10 billion more than required by law. Peterffy, IBKR’s founder, wants to show the financial world that they are the safest broker for holding your stocks. They’re aiming to attract even bigger clients to trust IBKR with their money.

Now that we’ve covered that, let's look at the total accounts of competitors for a quick TAM analysis. It’s clear there’s still plenty of room for IBKR to grow in terms of customers and assets under management.

Total Accounts of Competitors:

Fidelity: ~44 million

Charles Schwab: ~35 million

Robinhood: ~24 million

E-Trade (Morgan Stanley): ~5 million

DeGiro (Europe): ~3 million

Interactive Brokers: 2.8 million

Assets Under Management (AUM):

Fidelity: ~$4,500 billion

Charles Schwab: ~$7,500 billion

Robinhood: ~$80 billion

E-Trade: ~$360 billion

DeGiro: ~$43 billion

Interactive Brokers: ~$380 billion

With these numbers, IBKR has a lot of potential to grow its customer base and increase its assets under management. I’ve found five potential ways IBKR can achieve this growth:

Industry growth

Growing market share

Growth of introducing brokers

Growth in international markets

Acquisitions

How will total accounts continue to grow?

1) Industry growth

The brokerage industry is growing worldwide. According to Mordor Intelligence, the electronic brokerage market is expected to grow by 6.5% annually until 2030. Even during tough times, like the bearish market of 2022 when the S&P 500 fell by 18%, brokers still saw account growth. For instance, Schwab's accounts grew by about 5%, while IBKR's accounts grew by 25%. This shows that even when people are losing money in equities, the number of accounts keeps increasing.

2) Growing market share

IBKR currently has $380 billion in AUM, which is less than 1% of retail equity. They are well-positioned to gain market share from competitors due to their superior value proposition, including higher interest rates on cash, lower interest rates on margin loans, advanced products, global reach, and low costs.

There’s also a short-term opportunity for IBKR to gain market share. The pandemic drew many new investors to zero-commission brokers like Robinhood. However, both Robinhood and DeGiro heavily rely on PFOF, where brokers get paid for directing orders to specific market makers, often leading to higher execution prices for customers. The European Union plans to ban PFOF starting in 2026, and if the US follows, these companies could face significant challenges in maintaining their business models. Remember, Robinhood is unprofitable on their platform, even with PFOF still being legal!

IBKR doesn’t rely on PFOF. They generate revenue through interest on margin loans and commissions on trades, making them more robust and way less vulnerable to regulatory changes.

3) Growth of introducing brokers

Introducing brokers are firms that use IBKR’s backend systems but handle their own marketing and customer service. Customers interact with the introducing broker, not realizing they are using IBKR’s infrastructure. This is great for IBKR because it allows them to focus on its trading platform while partner brokers manage customer acquisition and service. About 22% of IBKR’s accounts come from introducing brokers.

IBKR's platform is attractive to introducing brokers because it provides them with the infrastructure without heavy investments in technology. Partner brokers can then mark up commissions and interest rates while remaining competitive. This benefits both parties: IBKR gains scale and efficiency, and introducing brokers can offer high-quality service without significant infrastructure costs. As connecting with different markets and trading various products becomes more complex and costly, smaller online brokers are increasingly outsourcing their backend operations to companies like IBKR.

4) Growth in international markets

Reading Hans Rosling's "Factfulness" convinced me that the world is getting richer (almost) every year, which will increase the popularity of investing. Investors worldwide want to own shares of major global companies. While there’s a lot of competition in North America, globally there’s less competition among brokers.

In many countries, brokerage accounts are managed by big banks with high fees and weak trading tools. IBKR's strong value proposition appeals to customers wanting to trade global securities. Two-thirds of IBKR’s 2.8 million accounts are held by investors outside North America, and these international accounts are growing faster, according to management. This suggests significant potential for continued international growth.

5) Acquisitions

IBKR is open to acquiring other firms. While many acquisitions destroy value (McKinsey), IBKR’s management is conservative and cautious about this. Good capital allocation is crucial to my investment philosophy. Luckily, the CEO, Milan Galik, has said:

“So, as you know, we have significant cash reserves, significant amounts of capital that we could deploy and would like to deploy. We have been looking for possible acquisition targets. They are all in our industry. They tend to be brokers who are less efficient than we are. We have closely looked at a number of them. We either find the price to be too high for acquisition or find that the acquisition would represent a very significant amount of work in terms of the integration. So far, we have not found any target that we would actively go after. But we hope that that will change in the future.”

This shows prudent capital allocation, which is a good sign.

3. Is it run by a competent management team?

IBKR is led by its founder and largest shareholder, Thomas Peterffy. I prefer companies with owner-operators because they usually focus more on long-term value creation compared to those with professional managers and so-called independent boards. High insider ownership is another essential for my investment style. As Thomas Sowell said, “It is hard to imagine a more stupid or more dangerous way of making decisions than by putting those decisions in the hands of people who pay no price for being wrong.”

Thomas Peterffy: The Owner-Operator

IBKR's success can largely be attributed to Thomas Peterffy. One of the world's wealthiest individuals, Peterffy essentially invented digital trading. Born in a basement during a Soviet bombing in Hungary, he eventually moved to the United States, bought a seat on the American Stock Exchange, and dived into trading equity options. Believing in automating manual processes, he introduced handheld computers in the early 1980s, revolutionizing trading and setting the stage for Interactive Brokers.

At 79, Peterffy remains highly active and passionate about the business. He personally visits companies and speaks with analysts, showing his dedication. He also participates in all quarterly earnings calls, handling the tough questions himself.

One of Peterffy's more controversial decisions is retaining most of the company’s earnings. He wants IBKR to be a safe haven during market downturns, having experienced multiple crises (Asian financial crisis, dot-com bust, 2008 financial crisis, COVID-19 pandemic). By holding onto earnings, he aims to ensure IBKR is seen as the safest option when markets are stressed. Peterffy knows that in periods of stress, there’s only one (financial) company customers go to: the safest one. While these retained earnings could also be invested with higher returns, this strategy is like buying an insurance policy: small costs most years with occasional big payoffs. Recently, IBKR raised its dividend by 150%, indicating confidence in their safety and a willingness to return more earnings to shareholders.

Peterffy’s integrity is also visible in his compensation package. According to the proxy statement, "The Compensation Committee has traditionally set Mr. Peterffy’s compensation as salary only, capped at 0.2% of IBG LLC’s net income." Additionally, "We have never issued stock options to our employees," which feels very shareholder-friendly.

Insider Ownership

Thomas Peterffy and his affiliates own approximately 91.3% of Holdings, which in turn owns about 74.6% of IBG LLC. This significant ownership is exactly what I desire as a shareholder. Management’s interests are aligned with those of common stockholders.

Other Key Management

CEO: Milan Galik joined in 1990 as a software developer and has been CEO since 2019.

CFO: Paul Brody joined in 1987 and has been CFO since 2003.

CIO: Thomas Frank joined in 1985 and has been CIO since 1999.

The proxy statement notes that "Our named executive officers have an average of 38 years tenure with us." Such long-term dedication is out of this world and speaks to the stability and experience of the management team. It also says a lot about the culture inside of IBKR where there’s evidently the opportunity to advance higher.

4. Is it available at a reasonable valuation?

I’ve said a lot already, so I’ll keep the valuation short and sweet. I started buying IBKR around $80 when it was trading at a P/E of about 15. Since then, the stock price has increased significantly. In 2024, IBKR is expected to earn $6.60 per share, which puts the current P/E at around 19. This is in line with its typical valuation.

Thomas Peterffy has stated that he expects customer accounts to grow by 20-25% annually over the mid to long term. More customer accounts mean more trades and more revenue from commissions, although new customers usually contribute less to revenue than existing ones. Historically, IBKR has grown earnings at about 15% per year, and I don’t see this slowing down anytime soon. If dividends continue to rise due to IBKR’s substantial cash reserves, this could further add to returns.

Profits have surged due to higher interest rates. If interest rates decrease, IBKR’s profits may also decline, impacting its valuation. Predicting interest rates is tough and I can’t do it, so my investment thesis doesn’t rely on them remaining high. IBKR performed well in a low-interest rate environment, so if rates stay high for some time that would be a bonus. Regardless of interest rates, customer accounts are expected to keep growing which is what matters most.

Conducting a scenario analysis is quite difficult due to IBKR’s short-term cyclicality. However, over the long term, IBKR has shown consistent growth: in the past 18 years, revenue from commissions has never declined over a two-year period, customer equity has never dropped, and the number of accounts has never decreased over a year.

Here’s a brief scenario analysis:

Over the past 10 years, revenue has grown by nearly 14% annually. Being conservative, let’s assume 12% annual growth for the next five years.

Assuming a profit margin of 60% (it was 71% in 2023, but that’s unusually high), and an exit multiple of 17.5, I estimate a CAGR of around 8% from today’s prices.

If the profit margin is 65%, the CAGR could be about 10%. Of course, if you want a CAGR to be above 10% then it’s easy to shuffle around some numbers.

Be cautious of screeners showing incorrect market cap figures. IBKR’s market cap is $53 billion, not $13.5 billion. Some screeners only consider 25% of the market cap due to the ownership structure. Remember, if you use $13.5 billion, you should also adjust revenue and earnings to 25%, so the ratios remain the same.

In summary, based on my conservative estimates, IBKR offers a potential CAGR of 8-10%. If that is too low for you, then IBKR might be an attractive company to put on your watchlist and wait for prices to come down. Be cautious though, high-quality companies might never really come back down again. Remember, in no way is this investment advice. It could be way lower too, but because of my conservatism, it could also be higher.

5. What are the risks?

Every company has different risks and just like in the engineering world with building bridges, it’s good to make a pre-mortem case. How could this bridge collapse, what are the main risks? In our case it’s how could IBKR collapse? Here’s a few I found:

No Market Volatility

Key Man Risk

Interest Rate Fluctuations

Exposure to Financial Crises

1. No Market Volatility

More market volatility usually means more trading, which is good for IBKR. But if the markets drop for a long time or just move sideways, trading activity can slow down, hurting IBKR's revenue. If markets are boring with minimal trading activity for a decade, IBKR could struggle.

2. Key Man Risk

Thomas Peterffy, the founder and largest shareholder, has a lot of control over IBKR. Some investors might be uneasy with this setup. While the management team has done a good job for minority shareholders and avoided shady deals, the heavy concentration of control is risky. If there's a leadership change or decisions that don't favor all shareholders, it could be problematic.

3. Interest Rate Fluctuations

High-interest rates are currently benefiting IBKR, but if rates drop to zero in a recession, it could be a problem. Lower rates might boost trading activity and support IBKR’s stock, but the company gains a lot from higher rates. The sweet spot would be stable or slightly lower rates, not a sharp drop to zero. Still, even if rates stay low, IBKR is likely to keep growing thanks to increasing customer accounts and earnings.

4. Exposure to Financial Crises

IBKR is at risk when customers default during financial crises or big market events. For example, they lost $104 million when oil prices went negative in 2020 and $120 million during the Swiss franc event in 2015. While they handled these losses, a major unexpected event could cause significant problems. IBKR has strong risk management and a hefty $4 billion in excess capital to cushion potential losses, but the risk is always there. That said, IBKR has a good track record of surviving financial crises.

These are four risks I could think of for IBKR but there must be many more. As Morgan Housel put it: “Risk is what you don’t see”.

Thank you all so, so much for making it to the end! A lot of work went into this deep dive, but it was so much fun and I learned a ton about Interactive Brokers. Hopefully, you learned something too. If you'd like to discuss anything, just message me on Substack or on X (@MindfulCompound). Feel free to share your thoughts since this was my first deep dive, and I'm keen to improve. The blog is long enough now, so thanks again and see you in the next one!

Luuk

-

Disclaimer: This analysis is not intended as investment advice but as a personal opinion and can serve as a supplement to your own research. The information is explicitly not intended as advice to buy or sell certain securities or securities products, but to provide an overview of the underlying company/companies. You are solely responsible for the decisions you make regarding your investments.

Thank you, it's a very helpful and well-structured review of the business. Not a likely addition to my portfolio at least at current valuation, but worth putting on the watch list. I also enjoy the product as their customer.

Have you seen the dilution? Share count in 2016 = 67 million, by 2020 = 81 million, by 2025 = 109 million.

Why does a company that has no debt and is churning cash need to keep issuing equity?

Stock based compensation is the answer.

Insiders are enriching themselves at the expense of external shareholders.

This kind of corporate cancer is prevalent in the US tech sector. Its awful. The regulator is asleep.

On that basis, I wouldn't invest. The share price is being inflated more by repurchases to offset dilution (and not doing a great job given the amount of dilution that is occurring), which destroys shareholder equity at these kinds of valuations, than it is being driven by fundamentals. That's a super dangerous situation for external investors.

Great company, great business, probably the best online broker out there (I use them myself), but that doesn't make it a great investment - despite the recent price spike. This is one where I would like to be an insider, but not an external investor.